This article comes from S&P Global ratings and is authored by Analyst Kyle M Loughlin, New York, kyle.loughlin@spglobal.com

The pace of change in the energy sector is accelerating, and the forces of disruption are here to stay. Indeed, topics such as the declining cost of renewables, advances in battery storage technology, and the de-carbonization of generation are increasingly on the agendas of utility board meetings–as well as S&P Global Ratings’ meetings with utility management teams.

These issues are no longer just fodder for esoteric discussions about some far-off future. On the contrary, we believe that disruptive factors are already influencing the direction of utilities’ business strategies and, consequently, our view of credit quality. For regulated utilities, this strategic shift is playing out with surprising speed and clarity, with more focus on grid modernization, de-carbonization to reduce emissions from generation, and developing a more-modular and adaptable approach to generation to prepare for increasingly variable load requirements.

Clearly, utilities will remain focused on the regulatory relationship and the pursuit of good economic decisions for ratepayers, but we believe these decisions are also increasingly influenced by the speed of technological development and a strategic desire to reduce enterprise risk inherent to the central utility business model. The latter is now more than just a back-to-basics reversion to regulated utility core operations; it’s about becoming more adaptable and opportunistic in a changing business environment.

Overview

• The pace of change in the power sector is accelerating, and the forces of disruption–such as battery technology, distributed generation, and renewable generation efficiency gains–are increasingly evident.

• We believe that these and other disruptive factors are already influencing the direction of utility business strategies.

• These strategies are playing a key role in record-high levels of capital spending, but utilities are maintaining credit quality through good strategic choices that reduce risk.

• A utility’s strategy–characterized by its generation fuel mix, investments in advanced technologies and grid modernization, and emissions–will likely have more of an impact on credit quality.

Utilities embrace renewables in their generation portfolio shift

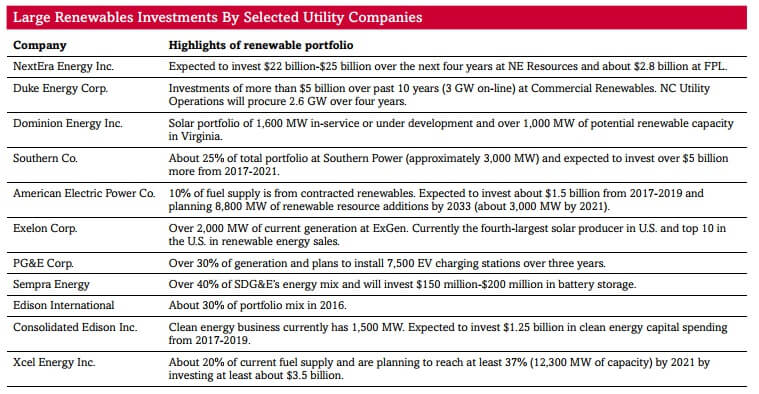

Forward-thinking utility management teams are already aggressively transforming their portfolios in several ways. We believe that the accelerating pace of change will challenge utility boards to carefully evaluate any large-scale generation decisions. This factor–together with state-level renewable portfolio standards and the sharp reduction in renewables generation costs–will promote increased investments in utility-scale solar and wind projects.

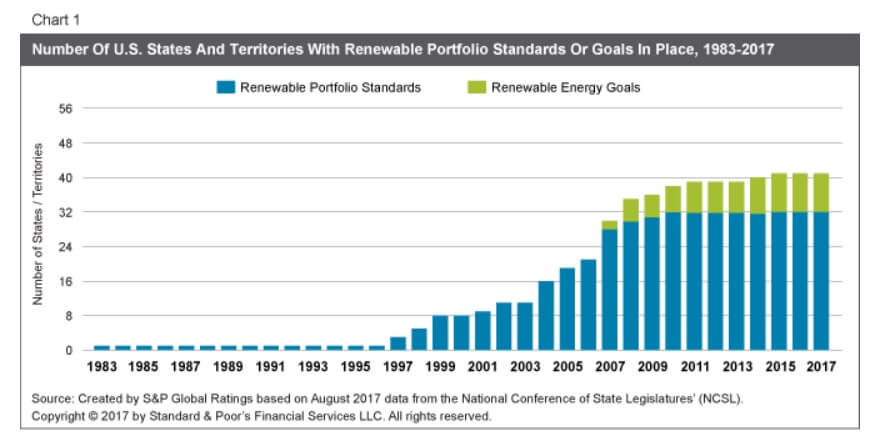

The shares of electricity generation from renewables and natural gas have increased in recent years due to economics and conversion opportunities from coal (see chart 1). We also believe nuclear power has begun a slow descent as a part of the U.S. generation picture (see “Nuclear Power And U.S. Utilities–A Half-Life Of 17 Years?” Sept. 22, 2017).

For a mature industry, we think that the pace of change in terms of U.S. power generation is moving at a good pace, with clear trends favoring more investment in renewables and highly efficient natural gas-fired generation and less reliance on coal and nuclear. In fact, in contrast with prevalent concerns just a few years back, investor-owned utilities are now positioned to play an important role in this transformation. In particular, distributed residential rooftop solar is viewed as a diminished threat to the viability of the central utility business model, particularly to those that are adapting to invest in utility-scale renewable generation (see “The U.S. Regulated Utility Sector Strikes Back At Distributed Generation,” Feb. 13, 2017). Improved economics associated with renewable generation support this trend, and utilities are able to benefit from scale efficiencies and by working with regulators to mitigate risk from earlier incentives favoring residential rooftop solar.

If the leading investor-owned utilities’ recent pronouncements are any indicator, regulated utilities are poised to play a major role in this market. We believe this reflects the economic realities that renewables are becoming more competitive vis-à-vis conventional generation sources, but it also reflects the aforementioned strategic shift to reduce risk in generation investments.

Increasingly, management teams are of the view that disruptive factors facing generation are important to recognize and that there is risk in not moving to a lower-carbon generation portfolio. While most U.S. states have established renewables portfolio regulations with mandatory standards–or at least goals for renewable generation levels–we believe that this trend is also about economics and risk management.

For example, companies that are reshaping their generation mix are less likely to face challenges, including from future regulators, because they were too late in recognizing the potential for disruption. These risks could include the potential weakening of the regulatory relationship, the most important element of business risk in the sector, or even stranded assets in the extreme. In our view, strategic decision-making by utilities’ management teams has accelerated the investments in renewables faster than originally expected. This is because of not only economic factors but also the recognition that technological change has forced long-term decision-making by prudent management teams dealing with a different paradigm. Modularity Is An Increasingly Attractive Concept In Generation Portfolios

For the full 12-page report, register here: https://goo.gl/nyqG6o

Filed Under: Financing