By Robert Speht, CEO and co-founder of FloatWind Ltd

By Robert Speht, CEO and co-founder of FloatWind Ltd

The world’s first gigawatt-capacity floating offshore wind farm remains a little way off, but advances across the industry are bringing it ever closer. As it stands, floating offshore wind farms have a levelized cost of energy (LCOE) of more than three-times that of fixed-bottom wind farms. And when commercial floating wind arrives, sometime near the end of this decade, the UK’s offshore renewable energy development agency (ORE Catapult) expects the weighted average cost of capital to still be 30% higher than for fixed-bottom offshore farms.

Time and experience have brought the per unit cost of building fixed-bottom offshore wind farms down significantly in recent years. But for offshore wind, and floating in particular, deployment timelines and costs are not only driven by engineering experience. Licences, bankability and the capital pool will all play a role in how quickly floating offshore wind can reach commercialization.

The obstacles to building offshore efficiently compound each other, as different locations bring their own challenges and require unique engineering solutions. Each solution needs to be reviewed, revised and approved by a round of consultants to reassure lenders and financiers of the soundness of a project investment. As a result, all this bespoke activity pushes up costs, meaning the capital pool can only reach so far. In effect, each offshore wind farm is a prototype project, each with its own expensive solution.

While floating wind has many advantages as a renewable energy solution, if the industry continues with a bespoke project-by-project attitude to building offshore, it will struggle to realize them in the face of uncompetitive costs. Fixed-bottom offshore wind farms have followed a path that has seen costs gradually fall over time as industry skills and experience have built up. But, for floating offshore wind to move down this path at a faster rate, new and innovative approaches will be needed to transform the logistics of wind farm development and construction.

A step-change approach to cost reduction

Offshore wind energy needs to take a broader view of what it can do to reduce the cost of wind farm construction. As an advanced manufacturing sector, many of the components in turbines come from suppliers experienced, and expert, in mass manufacturing, lean manufacturing and just-in-time delivery. These are all techniques applied to components and finished products up and down the value chain that reduce costs and make end-products cheaper and more popular.

Offshore wind energy needs to take a broader view of what it can do to reduce the cost of wind farm construction. As an advanced manufacturing sector, many of the components in turbines come from suppliers experienced, and expert, in mass manufacturing, lean manufacturing and just-in-time delivery. These are all techniques applied to components and finished products up and down the value chain that reduce costs and make end-products cheaper and more popular.

Our industry currently abandons this approach at the stage of turbine assembly and construction. Instead, a batch production approach, which only delivers wind turbines to order, actually slows down turbine production, limits availability, and pushes up costs. To reduce costs, the industry needs to apply lean manufacturing techniques all the way through to the end of the value chain.

Applying lean manufacturing and just-in-time supply chain principles to develop a ready-to-float turbine for the offshore wind industry will create an off-the-shelf product that developers can rely on. Developers and their construction teams will be able to collect floating wind turbines “off the lot” at the harborside and tow them into position, reducing costs associated with surveying, construction and installation, which can be more than 13% of wind farm LCOE.

Standardized, bankable units

A standardized production system that assembles ready-to-float-wind turbines will need to build supply agreements with wind turbine and floating foundation OEMs. By focusing only on the assembly process, the needs of the supply chain, the site of the assembly facility and quay, it will be possible to deliver a floating wind turbine with better quality, faster and cheaper. Standardizing ready-to-float wind turbines will reduce unit costs and create a supply of units to the market that will drive down the costs of installing floating wind turbines and facilitate a shorter installation schedule for offshore wind project construction — helping the world reach its net-zero commitments.

There needs to be a step change in the way the industry believes floating wind systems should be built and supplied to the market. Otherwise, there is a risk that full commercialization of the technology will be as slow, in its own way, as that of fixed-bottom offshore wind. High costs will limit the scope of floating wind to quickly achieve the terawatt-levels of annual installation needed.

But floating wind, with its many advantages over fixed-bottom foundations, should turn out to be quicker and simpler to deploy.

A floating first market

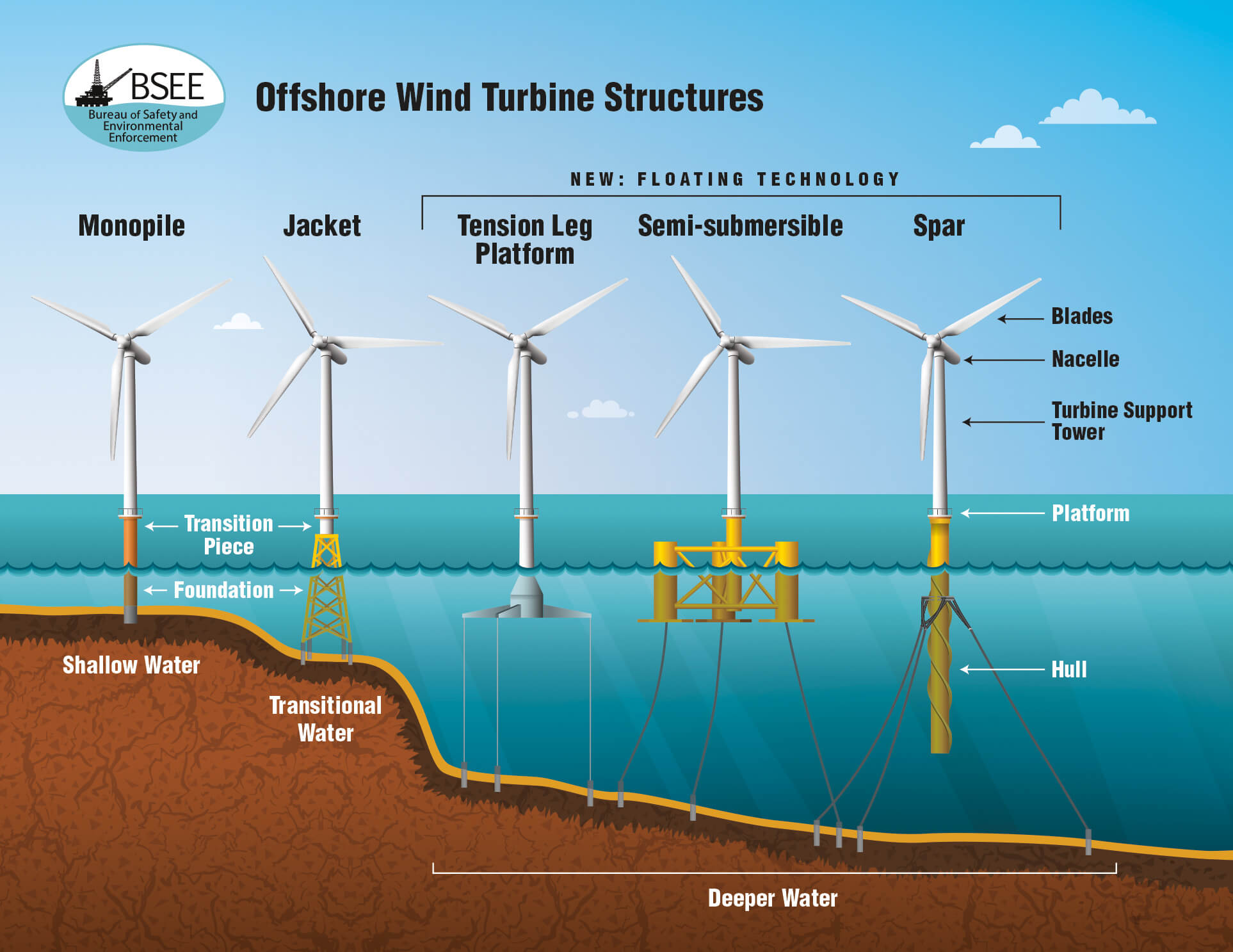

As a rule of thumb, the industry considers floating wind turbines only suitable for use in sea depths greater than 80 m. The higher costs of construction, installation and commissioning and the associated need to demonstrate bankability, limit the number of situations in which a developer would select a floating approach over a fixed-bottom approach.

However, in a world where a lean-assembled floating turbine system can be collected at harborside, floated to location, reductions in the time and costs associated with installing ready-to-float wind turbines are expected to be significant. Installation costs contribute around 13% of the LCOE for offshore wind energy, while it is estimated that the pre-assembly of floating foundation and turbine could cut this cost by up to 50%. Floating turbines can be competitive against fixed-bottom solutions at shallower depths, perhaps even as shallow as 40 m. Although this is dependent on the foundation design.

By adopting a mass production approach to building ready-to-float wind turbines, developers will be working with tethering, foundation and turbine systems that are proven bankable in any situation. As well as speeding the development process by reducing the challenges and costs of securing funding, this will make the path to commissioning wind farms simpler.

Cutting the time to the commissioning of a wind farm will deliver revenue much sooner for developers and investors and free up capital that can be used in other projects. With bankable, versatile floating wind systems available off the shelf, the industry will show current and future backers that floating wind is a long-term investable solution that can accelerate the world’s delivery on its climate commitments.

Robert Speht is CEO and co-founder of FloatWind Ltd. Robert is a renewable energy expert who has been involved in large onshore and offshore wind farm development projects internationally for 20+ years. Robert has been involved in renewable energy projects with a combined total of 13 GW of installed capacity and an investment value of more than US$23 billion.

Robert Speht is CEO and co-founder of FloatWind Ltd. Robert is a renewable energy expert who has been involved in large onshore and offshore wind farm development projects internationally for 20+ years. Robert has been involved in renewable energy projects with a combined total of 13 GW of installed capacity and an investment value of more than US$23 billion.

Filed Under: Featured, Offshore wind

I see only Horisontal Axis Wind Turbines (HAWT) in the image above. Yet research shows the Vertical Axis Wind Turbines (VAWT) is much more efficient in wind farms: https://www.brookes.ac.uk/about-brookes/news/vertical-turbines-could-be-the-future-for-wind-farms/

In addition, VAWTs have much lower LCOE for floating offshore wind than classical HAWT so “Floating First” should be based on Vertical Axis Wind Turbines since it is the future of offshore floating wind.

Nanna is duly impressed!