By 2020, 65% of the U.S. fleet will be older than 10 years. Even now as the oldest U.S. turbines reach the 20-year mark, the question to consider becomes: Replace them, keep them flying, or something else?

Paul Dvorak, Editor

The wind industry in the U.S. looks like this: It boasts of 61 GW of wind installed in about 900 wind farms. About 1.2% of the projects are older than 15 years. Most machines are less than 10 years old. But there is a growing population of machines in the 10- to 15-year stage.

Those stats and other insights to the U.S. wind industry came from Kevin J. Smith, DNV GL Director, Asset Management & Operating Services at the recent WINDPOWER 2014 conference during the opening of a Gamesa sponsored discussion on repowering and refurbishing U.S. wind turbines. Gamesa and other OEMs have recognized the aging turbine population as an opportunity and presented ideas for upgrades that could push turbine retirement beyond 20 years.

Wind turbines as baby boomers

Parts of California look like a turbine museum with many small turbines, less than 500 kW on lattice towers. If they are still working at 20 years, they might keep working or retire to make room for a few utility-scale turbines with a greater total output. Photo: Roy Dvorak

Looking out to 2020, Smith says he sees a significant shift in the industry because about 65% of the turbines will be older than 10 years, a figure that corresponds to 30,000 turbines. “Life extensions have to be done on an individual basis because different turbines on a wind farm see different types of loading and different maintenance history,” he says.

The idea of repowering is not new. The decision was easy for the older wind farms in California. The old turbines had tractor drive trains, simple gear boxes, and generators of 300 kW and less. Components were easy to handle and early controls used mechanical relays and switches. PLCs arrived in the 1980s and 1990s.

An early example of life extensions in California comes from crews who took out the yaw systems because the machines would not have to redirect themselves in the mostly unidirectional wind flows. “Owners did the math and saw the value of not needing them. Just point them in one direction, and it will be good enough 98% of the time. That also took out costs,” says Smith.

In the next five to six years, owners and operators will have a lot on their minds making decisions on how to run their turbines. Possibilities include running a wind project as hard as possible for 18 to 20 years. Owners could extend life, or maximize production, or implement upgrades from the OEM, and if they do, what is the overall impact on turbine life? “Just run the machines as hard as possible and then get the newest versions. That is one option, and there are others to consider. Each has a different cost and performance benefit, so there is no right or wrong way of making the decision.

Smith says it’s now time to take that thinking and apply it to new, multi-million dollar machines run by computer systems and built with complex materials. The next round of life extensions will greatly differ from what happened in the past because the turbine OEMs have also entered the game.

The geographic distribution of older machines from the 1980s counted mostly California and Minnesota. “By 2020 we will see aged machines spread across the states. What is important here are the different operating environments,” says Smith. These include wind regimes, different factors underpinning economic decisions, different PPAs, and different permitting constraints. “Such factors will play into an owner’s decision to repower an asset. So the decision will be more complex than in the past,” he says.

Owners must also consider the year 11 effect. “It stems from the Production Tax Credit, a 10-year tax scheme that creates a type of ownership structure to monetize the tax benefits over the first 10 years of operation. When years 10 and 11 hit, the tax equity takes a different role in the project,” says Smith.

Those with minority ownership may leave the project when the tax benefit expires and let new ownership take over. When this “flip” occurs, new investors come into older projects, sometimes with debt financing in place, other times not. “New ownership perspectives may come into the project which seek to maximize the return on investment through installing performance enhancements, or running the assets longer, or both” he says.

Finally, wind power has a hedge value on volatile pricing in the energy market because it lacks the volatility of fuel costs. Running a wind farm extra years does not add more fuel volatility costs to consumer prices. That is, wind keeps consumer prices pointing down.

Smarter upgrades

We are used to computers getting upgrades from software developers. Turbine OEMs are also recognizing a similar value because they can update the turbine controller and other elements of the machine to improve performance or mitigate load.

- “Load-control monitoring is available to monitor critical components so the machine makes active decisions to balance production versus equipment load. This is early technology not available on all machines, but it will become more prevalent,” says Smith.

- Permitting is another but more subtle driver, says Smith. For instance, interest in life extension comes from height restrictions on some property that makes repowering the machines impossible. The site may enjoy a good PPA, or other rules may have arisen since the project was built that takes repowering with new machines off the table.

- Increasing utility ownership. Many large utilities own wind projects. What is different about utilities is that they expect to manage and maintain wind assets as they do conventional assets.

While the wind industry comes around to this idea of a life extension investment as a new possibility, it is something utilities do all the time for coal and gas plants and hydro facilities. So it is a different way of looking at what a wind farm provides in addition to kilowatt-hours. “Utilities see managing wind generation and other renewable generation along with thermal generators, so they monetize how they operate their wind assets. For instance, new thinking about how to control and compensate wind power along with accurate wind forecasts could let utilities reduce some of the cycling on their thermal assets that would have added to their O&M costs,” he says.

“Some utilities now consider holding wind generators in reserve, a capability made possible with advanced power forecasting. Utilities can use wind to meet ramping power demands. When the wind is blowing hard, utilities can curtail their wind power production a bit and then bring it on almost instantaneously when needed. You can’t do that with other forms of generation,” adds Smith.

More new thinking

Other ideas finding merit include owners beginning to measure and document the load cycles on “flight leader” turbines in a project. These are the one or two turbines they know experience the highest wind or most turbulent conditions. Those machines are indicators of the life in the remaining machines. “This is a recent idea, a work in progress, because it requires correlating load cycles with stress on the structure, and how that can be used for predicting future life,” says Smith.

The 20-year design life is a frequent topic of discussion. Ask anyone what 20 years mean? Will a gearbox last 20 years? “That would be an expensive gearbox. If you look at designs standards – what the machines are designed to do – you find that there is a 1 in 10,000 chance of structural failure in 20 years. With 30,000 turbines, it does not mean that one will collapse each year, but as the turbines age, structural failures should be anticipated. In the 20- to 25-year period, owners may accept a higher level of failure risk by increased inspection and monitoring frequency as a cost-effective life extension method..

“We think a good balance between risk and rewards is a combination of proactive inspections and measuring campaigns so owners are not guessing. More methods are now available with retrofits and changes that take measures to reduce fatigue accumulations in the structure and material or at least be more informed as to how fatigue may be accumulating in machines,” he says.

OEM perspectives

Turbine OEMs have recognized the coming 20-year opportunity and are planning a range of upgrades. For instance, Gamesa, Vestas, and GE have made these announcements:

Gamesa’s upgrade ideas. The company is more than an OEM, reveals Warren Wilson as he introduced several of the company’s lines of business at a recent event. The latest of which is life extension plans for several particular turbines. These upgrades will focus on Gamesa G47 turbines, Vestas V47s, V80, V90, and GE 1.5-MW turbines. As an example, the G47s, initially 660-kW machines can be upgraded to 720-kW ratings with a new generator, hardware upgrades, and advanced controls. The modifications can give the equipment a 10-year life extension.

The company is not shy about thinking outside its own product portfolio. It also has plans for a few Vestas turbines. That Denmark-based company was quite successful selling its V47 wind turbines almost two decades ago. The company erected almost 6,000 of the 660 kW units around the world. About 1,600 are in the U.S. As they reach the end of their useful design life, owners now had at least two options: let the equipment stay running if it’s still capable of doing so, or tear it down and replace it with a larger turbine– repower the site.

Gamesa (www.Gamesacorp.com/en) engineers propose a third option: recondition and upgrade the turbine to 720 kW with an ROI of about five years and 10 years more working life. “An overhaul would upgrade a V47 with new converter and controls as well as replace the older RCC generator with a more modern double-fed induction version,” says Gamesa Global Services Sales VP Fernando Valldeperes at a recent meeting. “The work would also include a new coupling on the high-speed shaft and a torque limiter along with new cabinets in the nacelle and on the ground.” Blades with new root joints could also be replaced when necessary.

Structural improvements would include a reinforcement of the frame and a new reinforced gearbox, upgraded SCADA, and improved control algorithms. The upgrade comes with a two year warranty. The advantages of doing so, says Valldeperes, include grid code compliance, active and reactive compliance, and reduced maintenance costs.

The company says it is next considering upgrades to its own 850 kW and 2.0 MW series machines. To show the company is serious, Wilson said Gamesa has purchased a nine-turbine wind farm in Wyoming to demo company expertise.

Vestas’ upgrade ideas. The company says its PowerPlus program features a range of upgrades that bump power production by up to 5%.

Vestas (www.vestas.com) says it has already sold and implemented upgrades on more than 500 V82-1.65MW, V90-1.8MW and V100-1.8MW wind turbines across the world.

Vestas PowerPlus consists of three products:

- Power Uprate, a modification to the turbine control parameters, lets wind turbines increase their max power output from 1.8 to 2.0 MW (V82: 1.65MW up to 1.8MW). The result is an increased Annual Energy Production (AEP) of generally 1.0 to 4.0%.

- Extended Cut Out, a turbine-control modification, lets turbines capture more wind at higher speeds by extending the maximum wind speed limit from 25 to 30 m/s. The result is an increase in AEP of about 0.5 to 2.0%.

- Aerodynamic Upgrades are vortex generators. These cost-effective devices are small fins that improve blade aerodynamics and increase AEP of a wind power plant by about 0.8%.

GE’s upgrade ideas. Just one of the company’s recent ideas involves the technology demonstration of a 7-m blade extension, taking GE (www.ge.com) wind turbines from a 77-m rotor diameter to 91m. The company says the extension increases the swept area of the rotor by 40% and boosts energy production by more than 20%.

GE workers install the suction side of the extended blade in the YouTube video. (Google GE blade extension). All the curious details are blurred out but it hives a little insight to the process.

The technologies that make the extension possible include a centrally located insert, along with improved methods and advanced controls for loads mitigation. GE says the extended blades have undergone testing beyond IEC requirements, including static strength tests that are standard for all company-engineered blades and fatigue tests totaling more than 6 million cycles. The model and process use existing design margins of the 1.5-77 turbine in lower wind speed applications. In addition, modifications were made to controls and parts to adjust for the added loads on the turbine. Two prototypes, operating for 11 months, were completed with Noble Environmental Power at Noble’s Clinton WindPark in Clinton, New York.

The program was developed to help 1.5-77 owners achieve significant increase in power output on their existing fleet while maintaining existing product life and acoustics. GE adds that it has filed more than 16 patent applications and developed custom tooling for the extension installation.

“The blade extension program for GE is an example of the magnitude of technology advancements GE is capable of developing,” said Mark Johnson, engineering leader for GE’s renewable energy business.

The company also says that its WindPowerUp platform has secured more than 1,000 units under contract to date. PowerUp, a GE Predictivity product, is a customized software platform that lets wind-farm operators increase annual energy production on their turbines by up to 5% by taking environmental conditions into account. A 5% increase in energy output translates to up to a 20% increase in profit per turbine.

Wind farm manager for a day – the game

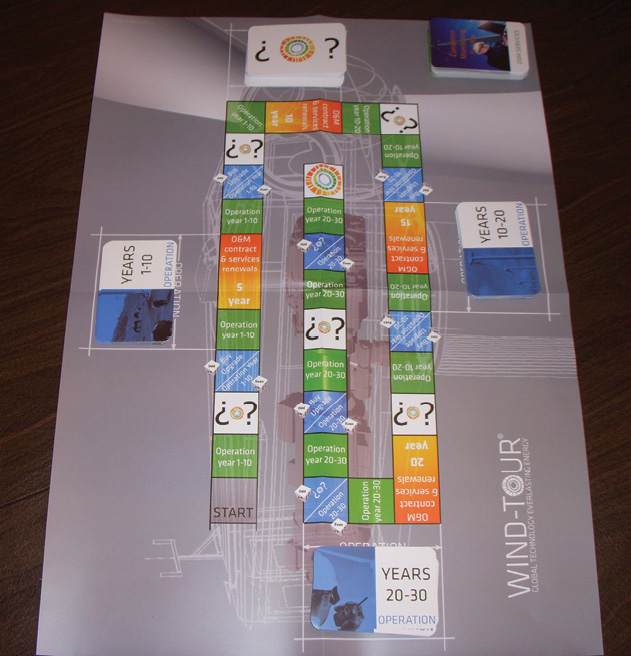

The board game Wind Tour, Wind Asset Manager, lets players see if they have what it takes to manage a wind farm to the 30-year mark.

The question of whether to repower or update aging turbines is one owners will eventually grapple with. For those of us that do not own wind farms, Gamesa offers to simulate the experience in a board game called Wind Tour, Wind Asset Management. As you’d expect, players roll a die and move a marker across a sequence of 30 squares on the board – the possible 30-year life of a wind farm.

Every space on the board represents one year of wind farm operation, and each player’s job is to act as the Asset Manager for their own wind farm. As the game proceeds, players move from one year to the next and are presented with challenges and actions that impact the state of the wind farm assets. Tokens are earned or lost based on the choices the players makes. The game occasionally directs players to draw from one of three stacks of cards to decide whether the wind gods favor you or not. It’s your turn.

Filed Under: Featured, O&M, Projects