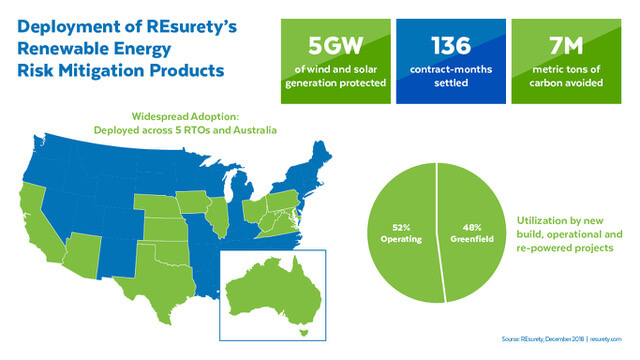

REsurety, a provider of valuation analytics and risk-management services to the buyers and sellers of renewable energy, announced that it has reached a critical corporate and industry milestone, having surpassed more than 5,000 MW of risk management transactions.

Transactions closed in 2018 with Microsoft, Enel Green Power North America, Engie, Orsted, Macquarie, and several other large international companies have fueled nearly half that cumulative volume in 2018 alone, signaling broad and accelerating adoption of REsurety’s risk mitigating products and services.

“2018 has been a breakout year for REsurety and for the industry’s adoption of risk-management tools,” said Lee Taylor, CEO of REsurety. “Our 5-GW milestone shows the incredible demand for certainty when it comes to buying and selling renewables. Both project owners and their corporate off-takers are finding our risk mitigation products to be an accessible and cost-effective way to avoid revenue or cost volatility.”

“2018 has been a breakout year for REsurety and for the industry’s adoption of risk-management tools,” said Lee Taylor, CEO of REsurety. “Our 5-GW milestone shows the incredible demand for certainty when it comes to buying and selling renewables. Both project owners and their corporate off-takers are finding our risk mitigation products to be an accessible and cost-effective way to avoid revenue or cost volatility.”

REsurety’s success in 2018 was highlighted by several high-profile transactions. Enel Green Power North America has used the Proxy Revenue Swap (PRS) hedging structure to support the revenues of 295 MW of its 450-MW High Lonesome wind project in Texas – marking it the largest PRS ever signed.

“The wind industry has made great strides in driving down costs over the last decade,” said Hannah Hunt, Deputy Director for Electricity Policy and Demand at the American Wind Energy Association (AWEA). “More recently we have seen improvements in driving down soft costs and REsurety’s approach of using weather and pricing data to reduce volatility risk is another great success story for the industry.”

Recent announcements by clean energy pioneers, such as Microsoft in the U.S. and Orora in Australia, demonstrate that buyers of renewable energy are also embracing REsurety products to manage the volatility associated with their purchases of clean energy. Both companies, as well as a third undisclosed corporate buyer, contracted for products that will help them manage the cost volatility of their renewable energy purchases, and will become an ongoing part of their procurement processes.

In 2018, REsurety closed 19 new transactions across its Proxy Revenue Swap, Volume Firming Agreement (VFA), Balance of Hedge and Proxy Generation PPA product lines.

“Taking on and managing the risks associated with vPPAs has become a real hurdle for corporate purchasers of renewable energy,” said Roberto Zanchi from Rocky Mountain Institute’s Business Renewables Center. “The early success of risk-mitigation contracts as a standard part of the procurement process sets a strong precedent for other companies who are similarly eager to achieve sustainability goals while mitigating financial risk exposure.”

As the global clean energy industry matures, the combined risks of power market volatility and intermittent fuel sources have migrated away from governments and utilities to the producers and end-consumers of clean energy. That increasing complexity and scale of risk requires a new breed of information and risk management products – with REsurety having led the way in developing those tools, in collaboration with Allianz Global Corporate & Specialty, Inc’s Alternative Risk Transfer unit, Nephila Climate and more recently Microsoft.

REsurety’s expertise in weather and energy market price information serves as the foundation for the successful insurance products that are offered by REsurety’s partners Nephila and Allianz. REsurety’s extensive proprietary data systems for weather and energy markets provides insight into the value and risk of weather-fueled renewable power generation. This constantly growing and expansive dataset, and related analytics, enables REsurety and its partners to offer a range of risk mitigation products catered to meet the specific needs of clean energy buyers and sellers.

Filed Under: Financing, News, Projects