By Jatin Sharma, Head of Business Development

GCube Insurance

Natural perils have contributed to an increase in wind-farm insurance claim severity over the past five years, and this trend is likely to continue as climate change causes volatile weather conditions.

The wind market is growing — up some 21% globally, according to Global Wind Energy Council — and expanding into new territories. This is good news for the industry, but also means a changing risk profile that can pose a concern for asset owners.

For example, low-wind regions are providing new opportunities for wind-farm developers but they must be willing to invest in a less established location and marketplace. A few of the challenges of charting new wind regions may include longer project lead times, less policy or political certainty, and a lack of supply chain expertise. An investor may label the challenges as too risky, particularly when compared to regions with a foundation in wind development.

Climate change, extreme weather, and Natural Catastrophe (Nat Cat) events also jeopardize project performance and pose risks to an investor’s profile. Fortunately, the industry is evolving to cope with challenging and changing risk profiles, and the insurance market is developing new products to protect wind-farm developers and operators. Here are a few risks typical of onshore wind projects with tips on how to protect wind portfolios.

Weather safeguards

Extreme weather and Nat Cat events are risk factors typically associated with offshore or less established wind markets, such as with remote island projects. However, recent weather in the United States shows that Nat Cat events also pose a threat closer to home. Severe storms and wildfires across the U.S. and Central America in the last few years have caused billions of dollars in losses to wind-energy asset owners, including turbine blade failures and tower damage or collapse.

Natural perils have contributed to an increase in insurance claim severity over the past five years, and this trend is likely to continue as climate change causes volatile weather conditions. Nat Cat losses typically fall into the “sudden and unforeseen” category accounted for by an all-risks’ insurance policy.

Tip: Asset owners in high-risk areas are wise to take precautions by ensuring that the design and specifications for their site are robust, and that appropriate contingency measures are in place.

Underperformance

Underperformance

The U.S. “wind drought” of 2015, in which some of the lowest wind speeds in history were recorded in key markets such as California and Texas, alerted the industry to the necessity of protecting project revenue against underperformance. Resource unpredictability is posing an increasingly prominent threat to profitability as lulls in wind speeds diminish asset output below expected levels.

Although inaccuracies in the data used to project asset outputs are partly to blame for financial vulnerability, wind-farm underperformance is typically the result of unpredictable climate phenomena.

Tip: Unforeseen lulls in wind speeds are covered by the insurance market, but it is important to find a flexible product. For example, Weather Risk Transfer (WRT) structures are adaptable to individual projects and portfolios. In a nutshell, WRT mechanisms provide project stakeholders with a means to stabilize future cash flows and minimize the impact of unexpected and adverse weather on revenue. In addition, a safeguarded minimum revenue enables banks and lenders to offer more favorable debt service coverage ratios, increasing a project’s value.

Mechanical issues

Wind turbines are assembled from thousands of components, so expect mechanical and electrical breakdowns at some point during operation. While quality components and a good O&M program can minimize turbine downtime, pressures to lower manufacturing and construction time and costs can compromise turbine reliability.

What’s more, the push for bigger turbines with more complex infrastructure means mechanical and electrical problems pose the greatest threat to a successful wind farm. For example, the production process for composite materials in turbine blades is precise and complex. Minor errors or material inconsistencies can have a large impact on a blade’s structural integrity. Third-party certification bodies have been slow to keep up with the advances in design, which has led some blade manufacturers to self-certify.

Although self-certification reduces costs for wind-farm owners, it also results in greater risks. In addition, the longer lead times for blades over 50 meters in length have led to an increase in the number of Business Interruption (BI) claims on newer turbines.

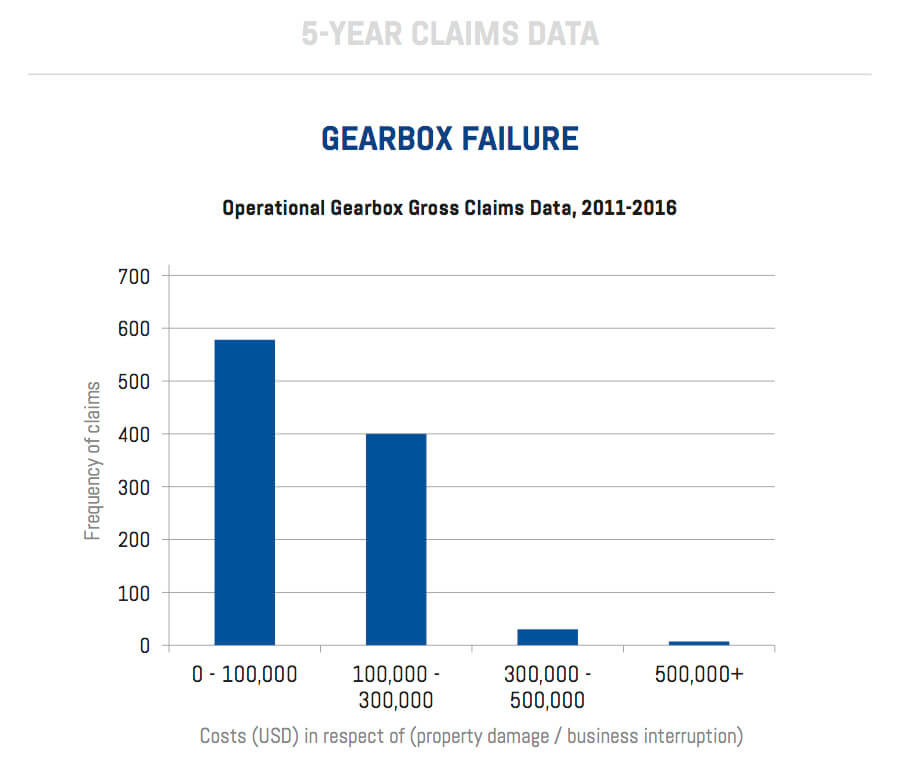

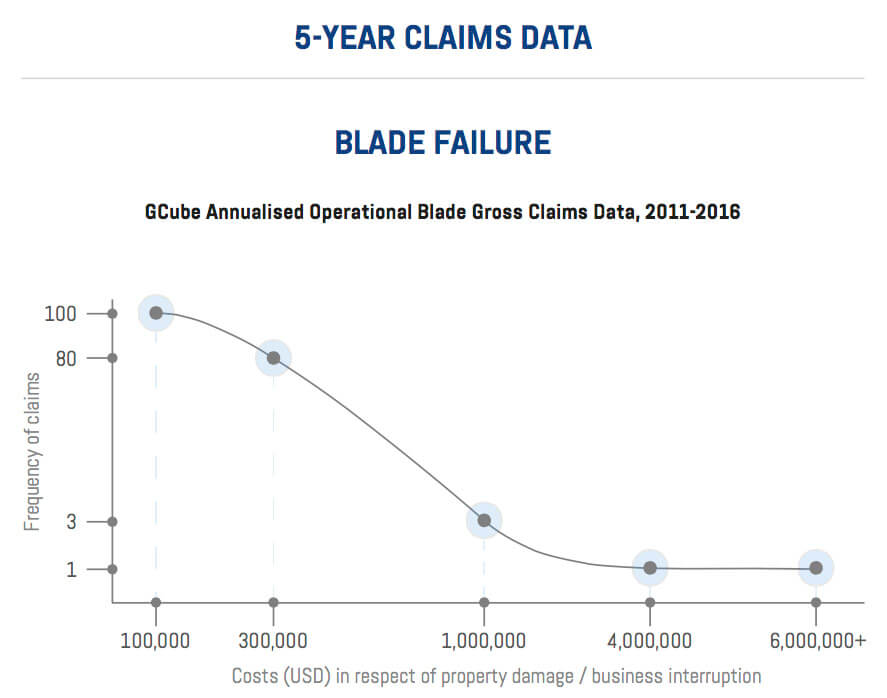

Tip: Over the last five years, GCube has seen an average of 5,000 annual incidents of blade and gearbox failures. While gearbox failures typically result in losses of around $200,000 to $300,000, blade failures can cost up to $1 million to resolve. Hence, do your homework. Use quality components designed to tolerate your site’s specific wind conditions, and ensure components such as blades are third-party certified.

Location. Location. Location.

Location can make or break real estate deals, and the same can be said for wind farms. Most utility-scale projects are in remote areas, which can hinder maintenance and repair visits when something goes wrong. The rising costs of mechanical and electrical turbine breakdowns are partly attributed to the remote locations of many new wind developments.

Simple logistics can extend already lengthy lead times for new components or O&M teams. A lack of supply chain expertise in the remote markets of Asia and Latin America, for example, has resulted in damage to transformers and blades during transit, and serial defects in equipment manufactured closer to project sites. The availability of certified blade repair technicians and quality replacement equipment can also extend a project’s downtime and increase BI costs.

Tip: The North American market has its share of these challenges, so it is important to plan for adequate O&M and BI costs. Project developers in Canada must also account for accessibility issues, particularly during the winter months.

Political risks

Wind developers drawn to remote locations because of abundant weather resources may face other risk factors. Many emerging renewables markets exist under politically volatile regimes, or lack the statutory or legal systems to protect developers from the confiscation, expropriation, nationalization, or deprivation (CEND) of assets.

American firms have already been affected by changes to governmental policies. For example, U.S. developer Invenergy LLC recently filed a lawsuit against a Polish state-controlled company, Energa, citing actions that are “tantamount to expropriation.” In 2013, Energa terminated a long-term contract for the sale of green certificates with an Invenergy wind farm company. Invenergy has pursued its rights in court against Energa to overturn the contract termination

Tip: The insurance sector has responded to these developments with Political Risk Insurance (PRI) products. While regulatory challenges are expected to decrease as wind energy becomes independent of subsidy support, risks from CEND are only set to increase as developers expand their portfolios into territories where wind power is less established.

The risks posed to wind-energy assets indicate the need for developers to complete proper due diligence. Risk transfer and insurance mechanisms are an important part of that due diligence. After all, the right insurance products can make or break a project and portfolio.

Filed Under: Insurance, News, Projects