STATOIL’S BATTERY-STORAGE PILOT at the Hywind offshore wind farm presents value beyond the immediate business benefits for the farm. This is the case as the company considers the most profitable combination of storage applications in larger offshore wind farms and other renewables, according to Sebastian Bringsværd, Statoil’s project manager for Batwind (battery plus wind), the power-storage project that compliments the wind farm.

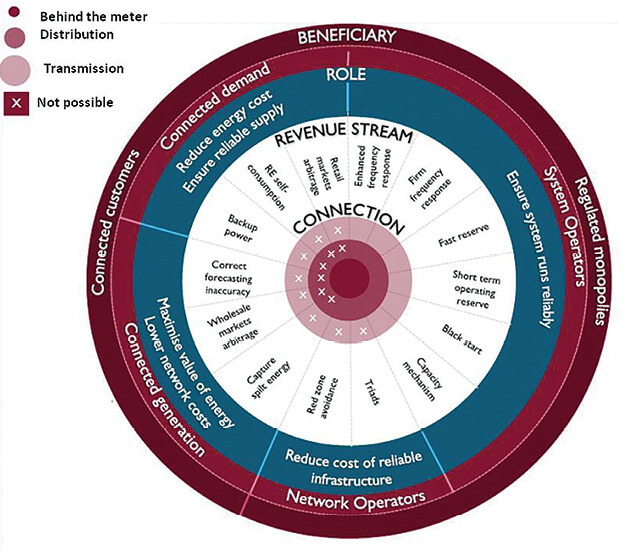

Energy storage brings additional capital expenditure so projects must also focus on accessing new revenue channels. To that end, Everoze has developed a storage revenue wheel that maps out revenue opportunities, of which there are more than 14 in the U.K.

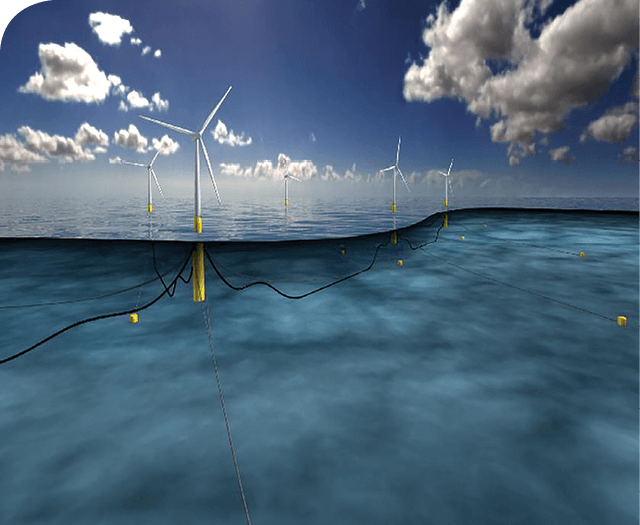

In March, Statoil announced it will install a pilot 1-MWh lithium-ion battery system to store energy from the 30-MW Hywind Park, the world’s first floating wind farm. The company expects that battery storage could improve the efficiency and lower the levelized costs for offshore wind, raising the value of wind.

The Batwind project will capture wind overshoots, reduce balancing costs, and increase the power’s market value.

Capturing value

Batteries often provide backup power in wind turbines, so that critical operation and safety systems keep functioning in the event of a grid-connection loss. “The opportunity in wind-generated power storage is whether it can be deployed to access new revenue opportunities,” said Nick Baldock, partner at specialist renewable energy consultancy Everoze.

He added that though the offshore wind industry is driven by cost-reduction targets, cost is just half of the equation. It is normally more helpful to express the economic benefit of storage in terms of new revenue streams, rather than simply reduced costs.

Statoil says it will install a pilot 1 MWh lithium ion battery to store energy from the 30 MW Hywind Park, the world’s first floating wind farm off the coast of Scotland.

Initial opportunities for energy storage are to capture excess generation, sell at peak price periods, optimize ancillary services, and potentially reduce transmission-cable costs. The lessons learned from the first large-scale offshore wind-storage project will help determine the exact value of storage systems.

Statoil is looking to deploy a battery system with high power rating, capable of quickly charging and discharging to fit specific wind patterns and targeted applications, as well as help maximize the value of the wind farm, said Bringsværd. The company is primarily testing applications and revenue streams, not technology, he said, adding that Statoil plans to remain technology agnostic regarding energy storage.

Statoil expects to choose a technology supplier for the project in the next three to four months and launch the battery system within the next 12 to 18 months.

Pending regulatory approvals, the company plans to combine the battery and converter into the wind farm rather than treat it as a stand-alone project. Furthermore, placing the battery behind the meter will let the company tap into a wider range of applications and business cases more critical to its core business – such as increasing energy production and revenues from projects – rather than limiting itself to only providing grid network benefits in front of the meter. The real business value lies in the different applications and ability to stack, combine, or optimize them as necessary, said Bringsværd.

Overplanting

Statoil will also test the use of storage to capture spilled energy from “overplanted” offshore wind farms. That is, where the wind farm’s rated capacity exceeds the grid connection capacity. The ability to store excess electricity and sell it when capacity is free could potentially reduce the levelized cost of offshore wind and boost revenue from an increase in the power exported.

Bringsværd added that Statoil expects small initial revenue gains from the pilot’s overplanting, though its potential benefits could be significant with commercial-scale deployment.

Everoze’s modeling shows that for a 1.2-GW offshore wind farm with a 1-GW grid connection, overplanting could amount to a revenue uplift of up to 4%. From a grid perspective, this can help make offshore wind projects work a little more like a baseload power plant.

However, according to Baldock, the capex investment required to deliver this overplanting application is currently prohibitively high, though it could change in the future as technology and system costs decrease and companies find an optimal revenue stack. For offshore wind, he said, the bar will always be higher than that for an onshore wind farm because of increased offshore capital and operational costs.

Self-balancing

Statoil will also use storage to help the wind farm reduce balancing costs by regulating its own power supply and avoiding negative pricing. This could also let the company bid in auctions based on a more reliable and predictable energy delivery.

Bringsværd added that Statoil could also use storage to reduce imbalance penalties it is charged when it sells intermittent power to traders. The company currently pays about 15% in penalties, which implies a potential revenue opportunity for storage.

Filed Under: Energy storage, News, Offshore wind