The 2017 Tax Cuts and Jobs Act may have momentarily taken the wind out of wind energy, but the industry is fighting back. The new tax law which decreases tax benefits for renewable energy has left developers and investors searching for a profitable path forward. Jupiter Renewables has offered an alternative to the outdated Disproportionate…

Jupiter Renewables creates PTC-based leasing structure for wind

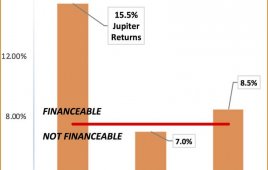

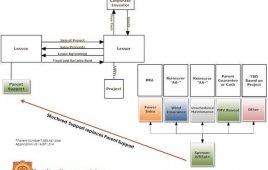

Jupiter Renewables has created what’s currently the only leasing structure for wind power using production tax credits. This process provides a powerful answer to an uncertain financing climate by: Generating a lower cost of capital than the industry standard “flip” structure Often delivering over double the present value to the project sponsors Making marginal projects…

Higher returns and higher advance rates aid YieldCos

YieldCos are a new vehicle similar to a Master Limited Partnership. They have raised $13B in public equity over the past three years. YieldCos are looking for new solutions after the “summer shock,” which saw their share prices drop by more than 50% from their peak and led to the closing of public markets for new equity. YieldCo’s can use the lease financing to develop three wind farms for every one wind farm using current techniques increasing Cash Available for Distribution and present values raising additional equity.