Editor’s note: This article from Lux Research should be of interest to the wind industry because more EVs on U.S. roads will boost demand for more power and ideally, wind generated power.

Tesla has recently shaken up conventional wisdom about its battery technology switching to NMC cathodes for most of its stationary products and making use of silicon anodes in its premium vehicles.

In November, Tesla Motors confirmed earlier reports that it will purchase LG Chem cells for a battery pack upgrade to its Roadster. The Roadster was Tesla’s first model offering, with around 2,500 vehicles sold between 2008 and 2011. However, only some Roadsters (the so-called versions 2.0 and 2.5) are eligible for the upgrade, limiting the total available upgrades to about 2,000 vehicles. In addition to a larger capacity battery pack at around 70 kWh, the upgrade also includes an improved aerodynamic package and low rolling resistance tires which will reduce drag and increase efficiency. All of these upgrades, as well as labor and transport to a service center, will cost the customer $29,000.

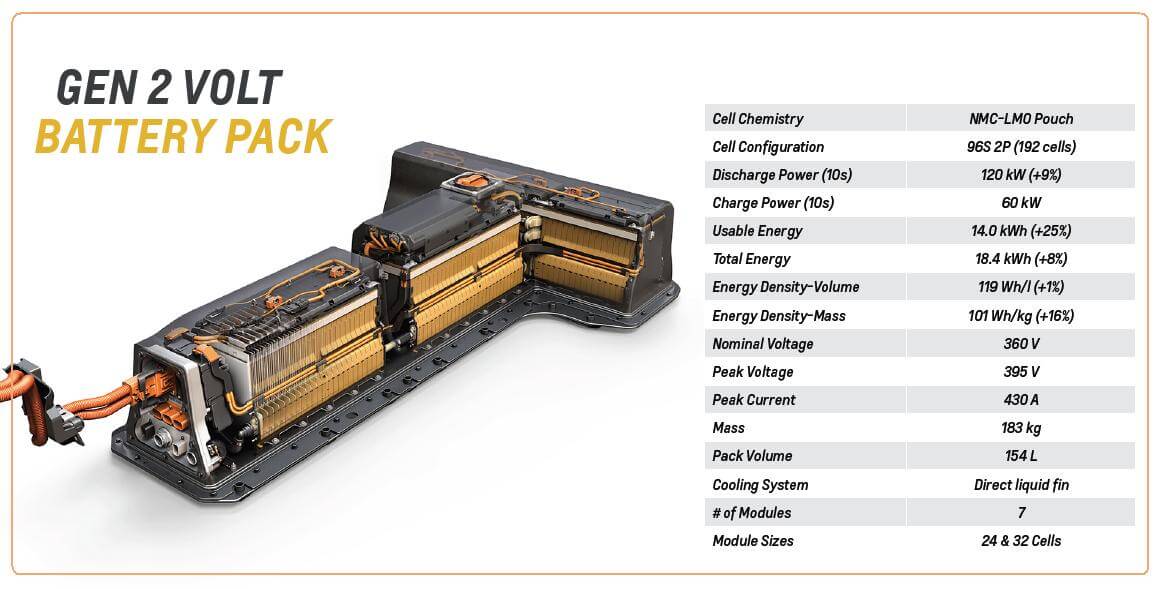

One key factor about the supply agreement is the cell format that Tesla will be using for the upgraded Roadster. Tesla has famously lauded cylindrical cells, and both its CEO and CTO confirmed that future cylindrical cells may increase about 10% in height and width from the existing 18650 format. On the other hand, LG Chem has exclusively supplied large format pouch cells like those found in the Chevrolet Volt for electric vehicles, although the company offers cylindrical and prismatic cells, as well. While the format remains unconfirmed, in the likely case Tesla will use LG Chem’s cylindrical 18650 cells. However, Tesla has recently shaken up conventional wisdom about its battery technology switching to NMC cathodes for most of its stationary products and making use of silicon anodes in its premium vehicles.

Overall, this is a relatively small supply agreement for both Tesla and LG Chem. Even assuming that all 2,000 eligible Roadster’s receive an upgrade, the battery upgrades would represent just a $60 million total opportunity for LG Chem.

Tesla, in comparison, is aiming to sell 50,000 Model S and Model X vehicles per year representing around 3.9 GWh and $1 billion in Li-ion battery packs. To date, Panasonic has been the sole supplier of Tesla’s Li-ion cells, and has committed to investing around 30% to 40% of the Gigafactory construction costs in a pay-to-play model (client registration required).

Panasonic will likely continue to be the leading supplier for Tesla’s vehicles with cells produced from the Gigafactory, but this deal represents a low risk opportunity for Tesla to test cells from other suppliers looking beyond the Gigafactory. It is worth noting that other OEMs, too, are going towards multiple suppliers for their cells, like Audi with its upcoming SUV (client registration required). Although Tesla and Panasonic are committed to the U.S.-based Gigafactory, Tesla believes multiple Gigafactories will be needed globally, and could ultimately choose to go with another cell supplier for those factories. However, this is a much longer term vision as Tesla will have excess capacity at the Gigafactory in Nevada for at least the next five years.

Meanwhile for LG Chem, although the dollar amount of the deal is relatively small, the company has been making inroads with major OEMs across the board, giving it a realistic shot at taking the top spot in electric vehicle market share (client registration required). Also important to watch in the future will be if more popular Tesla cars – like potentially more than a hundred thousand Model S sedans – will eventually receive their own battery pack upgrades, and who would supply that much larger opportunity.

To read more insights from Lux Research analysts visit Lux Populi.

Filed Under: Energy storage, News