The U.S. community wind sector, as a report from the Berkeley National Laboratory defines, consists of relatively small utility-scale wind power projects that sell power on the wholesale market and are developed and owned primarily by local investors. The recently published report explains this industry sector has historically served as a test bed, not only for up-and-coming wind turbine manufacturers trying to break into the broader market, but also for wind project financing structures.

For example, a variation of one of the most common financing arrangements in the U.S. wind market, the special allocation partnership flip structure, was first developed by community wind projects in Minnesota more than a decade ago before being adopted by the broader wind market. More recently, a handful of community wind projects built over the past year have been financed via new and creative structures that push the envelope of wind project finance in the U.S. In many cases, they have moved beyond the now-standard partnership flip structures involving strategic tax equity investors. The report explains this past year has seen a wave of financial innovation in the community wind sector.

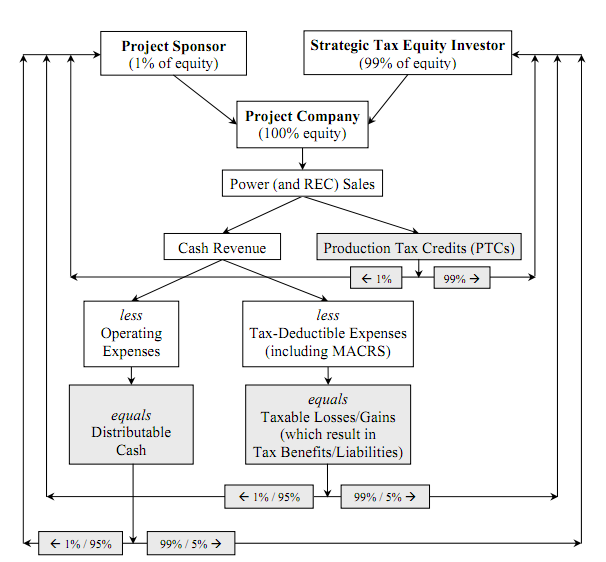

Schematic of strategic investor flip structure using the PTC. Forward slashes distinguish between pre- and post-flip allocations of distributable benefits. -Berkley National Lab

The partnership flip structure was first devised in response to the specific nature of federal policy support for wind power projects, specifically the inability of most individuals to make efficient use of the production tax credit (PTC) and accelerated depreciation. Likewise, so too has this new wave of financial innovation in the community wind sector been driven by policy changes, most of them recent. For example, as the report describes, for a limited time the American Recovery and Reinvestment Act of 2009 enables wind power (and other types of) projects to elect either the 30% investment tax credit (ITC) or a 30% cash grant in lieu of the PTC. This flexibility, in turn, enables wind power projects to pursue lease financing for the first time. Neither the ITC nor the cash grant is subject to the PTC’s requirement that the project owner also operate the project in order to be eligible for the incentive. The ITC and Section 1603 grant also reduce performance risk relative to the PTC, and (unlike the PTC) neither the ITC nor the grant is penalized for the use of subsidized energy financing. Finally, by providing a cash rather than tax incentive, the cash grant alone reduces, but does not eliminate, the need for tax appetite among project owners. All of these policy driven changes can be particularly useful to community wind projects.

Another policy-related enabler of some of the financial innovation profiled in the report include New Markets Tax Credits, which are not new but have only recently been tapped to help finance solar projects and, for the first time, in 2010 have been part of a community wind project financing. Also, Section 6108 of the 2008 Farm Bill expands the USDA’s authority to loan to renewable generation projects even if those projects are not serving traditional rural markets.

The collective experiences of the five community wind projects profiled in report can be distilled into the following common observations or lessons learned regarding the development and financing process. These include how the Recovery act was critical in the project, working with nearby projects can help ease the burden, partnering with experienced professionals pay of, take advantage of tax credits, and more highlighted in the report.

Filed Under: Financing, Policy