From the Berkeley Lab’s Electricity Markets and Policy Group:

Interest rates are a key factor in determining a utility’s cost of equity and investors find value when returns exceed the cost of equity. A recent technical brief, titled The Effects of Rising Interest Rates on Electric Utility Stock Prices: Regulatory Considerations and Approaches, quantifies the impacts of rising interest rates on utility stock prices and discusses policy approaches state regulators could implement to mitigate negative financial impacts.

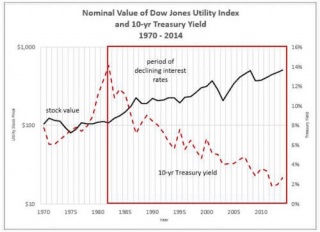

Through historical observations of periods of rising and falling interest rates and application of a pro forma financial tool, the key drivers of utility stock valuations were identified and the degree to which those valuations might be affected by increasing interest rates were estimated. The efficacy of responses by utility regulators to mitigate potential negative financial impact were also analyzed.

Regulators have several possible approaches to mitigate a decline in value in an environment of increasing interest rates. The policy discussion also considers the regulator’s obligation to consider consumer interests as well as those of investors and the tradeoffs of maintaining investor value with potential increases in customer costs when interest rates increase. Furthermore, the range of approaches reflects today’s many different electric utility regulatory models and regulatory responses to a decline in investor value will likely fit within state-specific models.

The technical brief can be downloaded here or from http://emp.lbl.gov/publications

Filed Under: Financing, News, Policy