Last year, THEnergy acquired an assignment from an international investor who focuses on large-scale installations. Investments of $12 million to 18 million per project were identified as a “sweet-spot.” “In project screening, we have come across many projects that are actually smaller,” points out Dr. Thomas Hillig, Managing Director of THEnergy. In the market, we see large-scale project sizes above all in the mining industry. Many mining companies have started to investigate renewable energy options for powering their mines. Several reference projects have shown mature technology for integrating solar or wind power into existing diesel-driven generators or gensets. Various new projects are currently being examined. Due to the global mining crisis, this market segment is developing slower than expected.

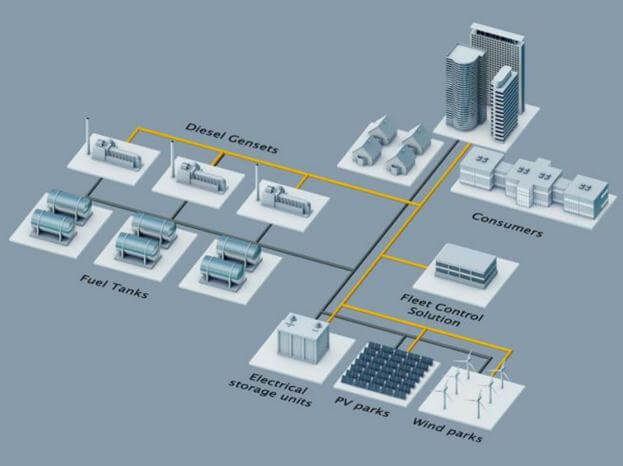

Siemens engineers have sketched out a possible hybrid power generation facility of wind, solar, and gensets for offgrid application.

“The business case for powering remote mines by solar and wind energy is still extremely attractive. Midterm, a wave of large-scale microgrid investments is to be expected,” explains Hillig. Short-term other market segments have developed faster. The installed base of diesel-gensets in small- and medium-scale applications is much bigger than for large-scale ones. Low diesel prices are also slowing down the large-scale PV projects in the off-grid market. At today’s storage price, low penetration renewable energy solutions are often the first choice. That means that for the same diesel genset often the size of PV and wind installations is not maximized, because pure economic criteria are more favorable for small- and medium-sized PV and wind projects. That, in conjunction with more favorable soft factors such as faster decision-making processes and higher attention to the environment than in mining, show that it is no surprise that the segment of small- and medium-sized projects is much more dynamic.

Other applications of this sort include remote hotels, resorts, lodges, agricultural, and other industrial fields such as cement, food, beverage or the infrastructure sector with hospitals, schools and shopping centers. Here, sometimes renewable energy has a direct impact on the end-customer. Studies show that hotel clients value green efforts in the hospitality sector. In applications with a good visibility by end-customers, renewable energy creates additional value beyond pure cost savings.

We also see that the renewable energy penetration plays a more important role and today many projects already include storage solutions. “In the small and medium-sized segment, commercial and industrial players actively drive the topic of renewable energy forward,” observes Hillig.

For investors who intend to build solar and wind power plants in the proximity of commercial and industrial off-takers and sell the energy on a PPA basis, this is a substantial advantage, because project acquisition costs are much lower than for slowly evolving large-scale mining projects. Due to high due diligence and financing costs, it is extremely challenging to handle mid-sized renewable energy projects for many funds.

“We are extremely pleased to have found agreement with a reputable renewable energy investor who has already successfully financed projects in Germany and in international markets,” says Hillig. “We reach out to commercial and industrial end-customers and also to project developers to discuss the financing of off-grid solar and wind plants, reducing the diesel consumption of diesel power plants.”

THEnergy has been actively driving forward the complex topic of financing off-grid renewable energy power plants for several years. In 2014, the company published the study “Solar-diesel-hybrid power plants at mines: Opportunities for external investors” which can be downloaded at http://www.th-energy.net/english/platform-renewable-energy-and-mining/reports-and-white-papers/. In November, Dr. Thomas Hillig will chair the finance session at the Energy and Mines World Congress in Toronto.

Filed Under: Financing