S&P Global Ratings has researched the top trends of North America’s regulated utilities. A summary is presented here. For the full eight-page report pick here.

First, a rating outlook. Rating trends across regulated utilities in North America remain mostly stable supported by stable regulatory oversight, mostly flat demand for utility services, but tempered by aggressive capital spending and tax reform considerations in the U.S. that will keep credit metrics from improving and weaken some entities depending on individual tax situations and regulatory/management responses. Emerging new technological and regulatory trends in historically stable Canada and the U.S. may have a far-reaching effect on utilities over time, but we see a limited influence from those factors in 2018.

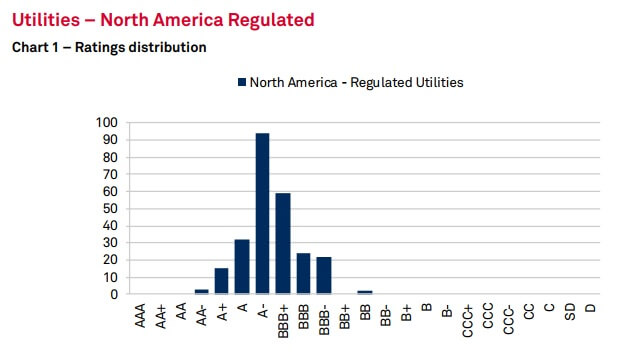

S & P Global Ratings sees a ratings distribution this way. Also, a grid transformation is becoming more prominent as utilities react to technological advances and other disruptive forces.

Forecasts

Credit ratios are likely to be stable to slightly lower in 2018 with some downside risk as U.S. utilities grapple with tax reform. Revenue growth will be modest in most areas in keeping with the flat demand growth. Margins across the industry in North America are expected to be flat to improving slightly as operating conditions and favorable fuel cost trends are maintained.

Assumptions

Sales growth at most utilities is loosely tied to the general economic outlook in its service territory, with low demand keeping growth flat or low for most. We project continued regulatory support for utility earnings and cash flow, with the occasional exception due to specific political or policy issues at the local level. Capital spending will continue to be elevated for most utilities, as infrastructure needs are not abating.

Risks and opportunities

Transformative risks abound in the Canadian and U.S. utility sector, especially in electric utilities. Corporate transformations (M&A) are an ever-present risk to ratings. Electric generation transformation is ongoing as carbon concerns and other environmental considerations lead utilities to change the mix of fuel sources. Grid transformation is becoming more prominent as utilities react to technological advances and other disruptive forces.

Industry trends

The utility sector in the U.S. and Canada is stable with some modest downside ratings exposure, consistent with our general ratings outlook and the nature of the essential products and services utilities sell. Tax reform in the U.S. has emerged as a more urgent issue and could on a case-by-case basis result in downgrades. However, the industry as a whole is well positioned to withstand mild shocks, and we see steady growth and stable credit quality overall.

Filed Under: Uncategorized