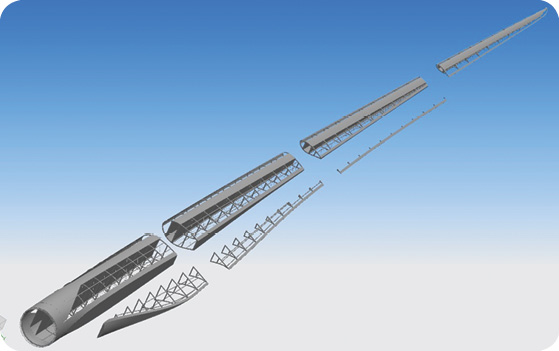

Kyle Wetzel’s modular turbine blade comes in seven sections for easier transportation to a wind energy site.

Global wind turbine O&M expenditures are expected to rise from $9.25 billion as of 2014 to $17 billion by 2020. That’s according to a recent report from consultancy firm GlobalData, which points to an increasing number of installations and aging turbines.

GlobalData analyst Harshavardhan Reddy Nagatham said that maintenance is vital to the commercial viability of wind: “Regular O&M reduces the downtime of a turbine and optimizes electricity generation, which leads to an increase in revenue. In optimal conditions, O&M activity guarantees a useful life of 20 years for a wind farm.”

In the U.S., an aging fleet is contributing to this surge far more than any new turbine installations, which isn’t exactly bad news for those employed in the O&M sector. Of the fairly impressive 4.9 GW of wind capacity that hit the market last year, in light of the expiring tax credits, less than 10% pertained to the installed base. But old or new, O&M expenses constitute a sizeable share of a turbine’s annual expense, easily adding up to 20% or 25% of the total levelized cost per kilowatt produced over its lifetime.

As a result, maintenance costs are garnering attention, as turbine manufacturers attempt to lower them through technological advancements. And, perhaps the number one thing wind farms have going for them is data. From installed sensors to monitoring software, it’s now possible to collect an abundance of information and predict turbine breakdowns and failures down to the spare parts that may be required.

Too often maintenance is carried out reactively, however, and as many in the industry have learned, merely identifying a damaged component doesn’t increase a wind farm’s profitability. It’s necessary to act on information early (preferably, before damage occurs) to optimize O&M activity. This is where predictive monitoring is becoming an industry norm. For example, one web-based software on the market utilizes data from existing CMS and SCADA systems, together with lubrication analyses and O&M records, to provide OEMs with a clear picture of the health of a wind farm.

Many companies are also integrating condition-monitoring technologies into mobile devices to provide engineers offsite access to real-time machine performance data. When equipment must be reset, it occasionally can be done remotely from a monitoring dock, saving transportation costs and time in the field.

Manufacturers are also looking at the source of O&M costs and are revamping equipment designs. Because gearboxes have a reputation for high failure rates, engineers are increasingly opting for direct-drive technology, especially for offshore turbines. These gearless, low-speed generators substantially increase reliability and reduce maintenance costs in the long-term, despite their high initial price point.

Others are focused on increasing gearbox reliability with stronger bearings, lubrication, gears, and end-of-line testing. While several gearbox models on the market have either three or four roller races on planet-gear bearings, one company has eliminated the problem by using a two-row bearing concept on planet gears, with an integrated outer race of the bearing into the planet gear.

Turbine blades are also playing a growing role in the drive to reduce costs. They are expensive components, representing up to one-fifth of the manufacturing costs of an onshore turbine. New hybrid materials are combining carbon and fiberglass properties to allow extending blade lengths without increasing weight. With growing turbine heights, lighter blades mean less stress on other turbine components and, therefore, less overall wear and maintenance.

Modular technologies and blade extension packages with variable tip lengths means blades can be optimized according to a customer’s request and a wind farm’s location. Aside from the decreased transportation costs of hauling long blades, modularization helps improve blade quality because everything can be inspected before it’s bonded, providing fewer margins for error and future repair expenses. WPE

Filed Under: O&M, Projects