The report and this partial executive summary were prepared for the Energy Storage Association and gmtresearch.

The U.S. Q2 2017 deployments in megawatts are 11% off from 2016.

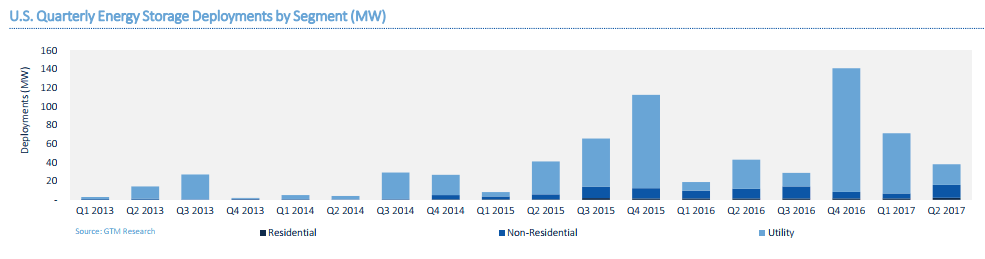

- The U.S. deployed 38 MW of energy storage in Q2 2017, a decrease of 47% from the 71.1 MW deployed in Q1 2017 and a decrease of 11% from the 42.8 MW deployed in Q2 2016. In general, Q2 sees marked growth over Q1, however, Q1 2017 was notable in that it included the final deployments from the Aliso Canyon procurements, which led to a record Q1.

- Behind-the-meter deployments actually increased by 141% quarter-over-quarter, with the non-residential segment growing 158% from Q1 2017 and the residential segment growing 70% from Q1 2017. The behind-the-meter segment continues to mature, and Q2 2017 saw both a clearing of the pipeline in California and Hawaii.

- Overall, behind-the-meter deployments accounted for 42% of deployments in MW terms in Q2 2017, compared to only 9% in Q1 2017.

The U.S. Q2 2017 deployments in megawatts are 11% off from 2016.

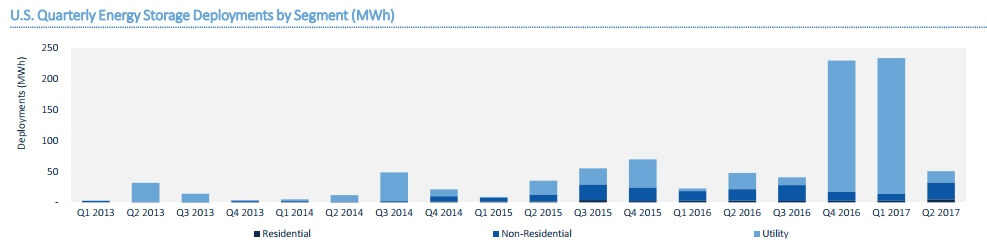

The U.S. deployed 50.4 MWh of energy storage in Q2 2017, down 78% from Q1 2017 but up 6% year-over-year. Q1 2017 was a record quarter for energy storage deployment as the final Aliso Canyon projects came online, and thus a sharp decrease in Q2 2017 was expected.

• Behind-the-meter deployments rose 140% quarter-over-quarter. The residential market rose 89% from Q1 2017, while the non-residential market grew 151% from Q1 2017. Much of this increase resulted from queues clearing in both California and Hawaii.

• Overall, behind-the-meter deployments accounted for 63% of deployments in MWh terms in Q2 2017, which results from the fact that the majority of utility-scale systems were short-duration (discharge duration of 30 minutes or less).

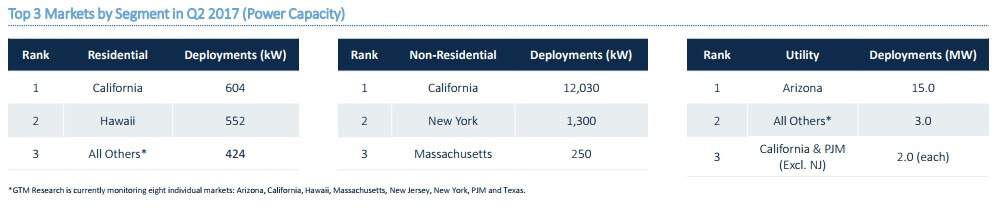

Top three power capacity markets by segment in Q2 2017

In the case of distributed energy resources (DERs), a category that includes energy storage, investments come from a variety of actors including electric utilities, traditional energy developers, technology conglomerates, financiers and even private individuals. DER investments are an important metric for assessing how these various investors view a technology by examining factors such as the size and frequency of investment coupled with the types of companies that receive investments or in some cases are acquired.

Today, storage accounts for a small but growing proportion of investments and mergers and acquisitions in the DER ecosystem. Firms across the world are exploring the value storage can provide and are injecting cash into the storage space. Generally speaking, most early-stage capital has found its way into the storage-focused software vendor space.

While the Energy Storage Monitor report series focuses on the U.S., the following chapter compares U.S. investment activity to that of Europe. The European energy market is further along in many ways than that of the U.S., with greater adoption of renewables and broader commitments to building the energy system of the future. Europe and the U.S. have different sophistication and maturity levels across the DER space, and the varying investment levels bear this out. Looking at storage alone, however, paints an interesting picture of key differences between U.S. and European firms when it comes to investing in storage.

For the full executive summary: https://goo.gl/3mSSTo

Filed Under: Energy storage, News