Data is king in securing the financing for a new wind farm. Ideally, a developer needs two to three years of wind measurements from several met masts on site, along with data from a lidar unit that has been moved about the site. That was one message from OST Energy Director-Wind Nick Fleming. “That amount of wind data would be ideal. But we have also learned it is possible to generate assessments with relatively poor data. All available data adds significant value. It is possible to bridge the gap when the full picture is not available, and make good judgement calls on what uncertainties exist at a particular site,” he says.

UK consultant Nick Fleming has ideas for smoother development and construction plans for wind farms.

OST Energy is a technical consultancy firm headquartered in the UK. Fleming said the company’s expansion plan is to diversify geographically and technically. “Our ambitions in the U.S. are built on our global experiences, so we are seeing similar issues and technicalities. A couple of things we see in the U.S. are transmission and connection issues. They are a global challenge for the wind industry whether projects are in Oklahoma or in India. Projects are all driven by the offtake of power while finance issues are common to most projects.”

On the finance side, Fleming says his firm is familiar with complex finance structures in the U.S. “For instance, the P99, a calculated certainty for project success, has become absolutely critical to financing. A sophisticated and reliable uncertainty analysis also supports that kind of requirement from lenders,” he adds.

As for trends, Fleming see that turbines are getting more sophisticated so they’re able to operate in either current leading voltage or current lagging voltage mode assisting with local network voltage control or low voltage ride through issues. “We are seeing in the U.K. that when storage technology is tapped for service, it is mostly for frequency response. And that knowledge will have application in the U.S. as well. We are trying to bring the knowledge from different parts of the world where it applies.”

Regarding wind-farm development, Fleming says several problems crop up frequently. “The one we always see on the analysis side is a lack of sufficient data. It is expensive to have all the data-collection equipment at a potential site but it really does make a significant difference when asking for financing on a P90 or P95 value. So the more data, the better.”

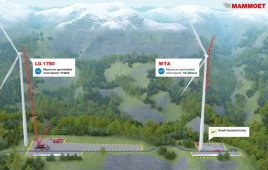

Ideally, a developer needs two to three years of wind measurements from several met masts on site, such as this one being installed by WINData LLC, along with data from a lidar unit that has been moved about the site.

Fleming said the number of met masts should be representative of the terrain and it must collect data long term, at least two years ideally, particularly when there are limited correlation data sets from trustworthy and nearby facilities. “Nearby airfields and weather stations are useful. Even tapping into operational data from nearby projects can add value to an assessment. Lidar makes it possible to deploy short-term measurements around the site, so rather than having to employ mobile masts, a lidar campaign should move around the site collecting wind data in three to six-month intervals

Another key oversight would be turbine selection. “I would advise against the lowest cost turbine because the devil is in the details of the purchase contract. You have to drill into the warranties and into the O&M capability for the OEM’s available support. If you are not going to use the equipment OEM technicians to maintain the plant, you need to know of the experience of the third parties in your area,” he added.

What’s more, turbines are improving fast. “If you make an early selection, six to twelve months down the track there may be a better turbine on the market worth getting approval for. We are seeing greater penetration of 3-MW turbines in the U.S. These have been more of the norm in Europe over the last five years. I can understand why the 2 and 2.3-MW turbine are widely selected – they are a benchmark. There are lots of them. It’s easy to see how they will be maintained, and they will be delivered sooner to take advantage of the PTC. But I expect more of the 3 and soon 4-MW units, and they will optimize revenue.”

The PTC has alleviated scheduling issues as well. “Not long ago we were putting turbine deliveries on a fast track to fall within PTC timeframes. But the PTC issue has gone away now with deadlines four years out. Scheduling was a big challenge in the U.S. before when it was renewed in one and two-year spurts. The worst thing now about a wind farm timing is to make a mistake in construction and you have to fix during operation. The best projects are those where the plan was systematic, well thought through, and not in conflict with contractors,” says Fleming.

One thing he says as a consultant that must be conveyed is that the project works for owners and lenders. “Owner engineers have a particular project perspective. They are trying to resolve issues that have many shades of grey, get on track, and do deals with contractors to make things happen. As a consultant, you learn about genuine construction risks. If you look at this as cold black and white, as a lenders’ engineer, then it is all about risk and risk management,” says Fleming. “It’s not always a realistic perspective so you can say this risk is high, but you still have to ask ‘how is it high?’ Is it a cost issue, or a delay to the project? So we try to tie these two elements together. It helps when both parties have this information so we can say to developers: ‘These are what the lenders are looking for.’ But for lenders, we must explain why we occasionally disagree with their lawyers and why we think a particular risk is manageable.”

Most contractors are good when they are not under pressure, adds Fleming. You can talk to one contractor and he will speak with top-string project managers. “But if they are busy and you are onto the second string of contractors, that is when you begin to have issues. It’s true for OEMs. With civil works contractors, electrical contractors, every firm has clear good project managers and good skill sets. And when not under pressure, the projects are fine. But when they are all under pressure that is when you tend to get poor decision making.”

Filed Under: Construction, Financing, News