This article from Wind Energy Update was published in its newsletter of May 10.

Wind power firms are re-evaluating operations and maintenance (O&M) spending against asset values and new metrics to combat rising wholesale market competition, leading wind executives said.

After a significant drop in wind power costs in recent years, wind farm operators are now examining new ways to profit from technological advancements and ensure sustainable income streams in a highly competitive market.

The expiration of U.S. Production Tax Credits (PTCs) for aging turbines and the gradual removal of PTC support for new projects have prompted operators to re-examine operations and maintenance (O&M) activities. The PTC system provides 10 years of tax credits at $23/MWh for projects started by the end of 2016 and is scaled down annually to zero support for projects started by 2020.

The wind power industry must optimize service contracts and operational practices to take into account the falling revenues and rising costs of aging turbines, Patrick Woodson, E.ON Chairman, North America, said at the Wind O&M Dallas 2017 conference on April 11.

“There is an emerging mismatch between availability and profitability which are not really in the owner’s interests…We have to look at the evolution of the revenues over time and see how we can maximize these projects,” he said.

Windfarm revenues can drop by a third following the removal of the PTC and many of these wind farms also are also outside the window for acquiring a PPA, Woodson noted.

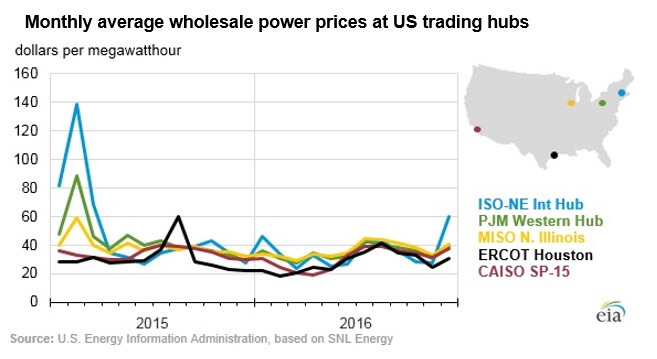

“By the end of 2017, we are going to have 20 GW of projects which no longer have any PTC values, most of which are facing extremely low power prices. It’s going continue to be a big challenge for all of us,” he said.

Future operating strategies must reflect the value point of each individual asset and apply appropriate metrics, Woodson said.

“For us, availability isn’t really the right metric anymore. We think there needs to be a greater risk-sharing approach now between service providers and owners,” he said.

Cost pressure

An industry drive towards lower costs has raised the profile of O&M efficiencies and firms are channeling learnings into plant development phases.

“We get a tremendous amount of pressure to reduce O&M costs, just in the development of new assets,” Andrea Miller, Vice President of Asset Management Apex Clean Energy, told the conference in Dallas.

“At Apex we are investing pretty heavily in the tracking of parts costs and data associated with parts life and always looking for opportunities to find ways to reduce costs…”there will be continued pressure to drive down the cost of O&M and parts expenses, just to keep driving down the cost of energy without the PTC to help support the projects,” Miller said.

To read the article in full, click here.

Filed Under: O&M