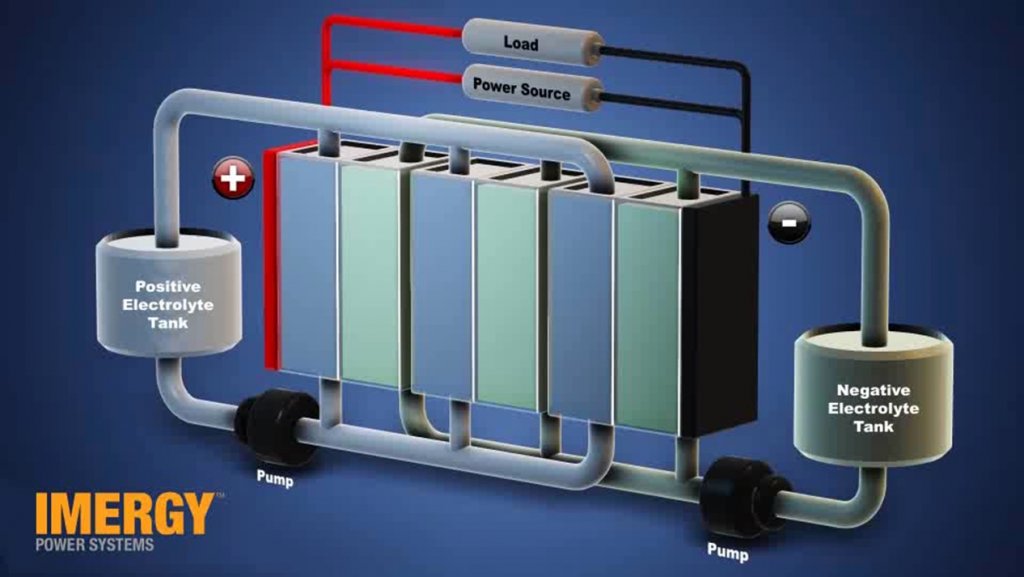

Storing power in a cost-effective manner is a sort of Holy Grail for the renewable-energy industry. While most methods have been a bit pricy, that may be changing. Manufacturers of vanadium flow batteries think theirs is a cost trend setter. For example, the big plus for vanadium is that it never wears out, the design tolerates deep and repeated charge and discharge cycles, and large units of 250 kW can be ganged for higher power output. “There are other advantages,” says Tim Hennessy, COO of Imergy Power Systems. “One is that there is no sulfuric acid as part of a mix that holds the vanadium. Other designs use the acid.” You always get the vanadium back and that is unique to vanadium. It is the only element on the periodic table that has four states of charge so that it does not affect the element,” he says.

“Our version has a different electrolyte formulation that allows making it more energy dense which allows a smaller battery and lower cost. And we can run at higher temperatures, 55°C without cooling, and down to -10°C without heating. So there is no need to heat or cool the battery box and that lowers cost.

In contrast, lead-acid loses power with low temperatures, and lithium batteries, when discharged too deeply, don’t recover well. The chemistry goes through a permanent shift or change. That does not happen in the vanadium batteries.

Perhaps just as significant, Hennessy says his company relies on waste sources to provide the vanadium. “There is plenty of vanadium in the world, it’s just not mined frequently enough to control the cost. There is 100 million tons of waste to mine for vanadium so there is no source issue. The mined material sells for about $11/kg. But we extract vanadium from mine tailings, fly-ash residue, and sludge in tar sands. These sources can drop our Vanadium cost to about $8/kg. That feat is part of our inventing,” says Hennessy.

Hennessy acknowledges that it is somewhat tricky to extract vanadium with sufficient purity for flow batteries. “However, an added formulation keeps dirty stuff from causing side reactions. That is part of our IP,” he says.

An inexpensive catalyst added to the mix suppresses side reactions from impurities in the lower-grade vanadium. “Every other battery requires a higher grade, 99.9% pure while ours works at 98% purity. So particulate or impurities don’t impact battery operation, and that is unique technology,” he adds.

What about efficiency? Round trip efficiency has two answers. “If the cycle is short, as it would be to smooth out wind variability, say 10 minute charges and 25 minutes discharges, efficiency goes up because you have short duration of charge and discharge, and efficiency is measured over time,” he says. When working with solar panels, they would charge at a flat rate ─ constant power ─ and discharge at constant power, in the fashion of a square wave. But over a long cycle, four hours each, would provide a worst-case efficiency. The round trip efficient will then be just over 70%. But shorten the cycle and efficiencies rises to 78%. The impact of efficiency is determined more or less by location and application.

A Lithium battery can have a round-trip efficiency of 90% but only over a range of perhaps 50% state-of-charge. “If the battery discharges to 20%, the Lithium efficiency drops to about 80% and the same for lead acid because they don’t like deep discharges. Vanadium flow batteries, however, tolerate deep discharges,” says Hennessy.

The company says the ESP250 can improve the power quality for utilities, renewable integrations, and mining operations. In addition, the peak shaving capability provides for significant cost savings.

He adds that ESP30s are arriving in the field, and the ESP250 is in discussion for 10 to 20 MW of systems. Close to 80 of the units have been proposed. “The main drivers for purchasing are energy costs and improving grid reliability. If you have lived in the developing world, you know power is not always there when it’s needed. Places in the world where the grids present great opportunity are from India to South Africa to Island communities. They all have massive irregular supplies,” he adds.

Microgrids, another opportunity, are more plentiful outside the U.S. “Eventually, we will develop solutions for outside the U.S. where needs are greater, and come back to the U.S. at better pricing than if they were built in the U.S. first,” says Hennessy.

For a utility, supply must meet demand at all times. Natural gas at $3/million BTUs is inexpensive making natural-gas “peakers” cost effective. “But when the price climbs to $5 or $6/million BTUs the battery becomes more competitive. In Germany, for example, natural gas is $9/million BTUs. Outside of the U.S., the rest of the world is paying more. Peaker plants there are expensive. But distributing batteries around the grid solves the peak-power problem. Put them in several load areas around the grid and you don’t need to add a new 60 MW peaker plant. Perhaps only six 6MW batteries would provide the equivalent, and they address problems closer to where they are, at the customer interface,” says Hennessy.

The battery application will depend on the part of the world. Generally, utilities have two options. One, they can put in 50 MW gas powered turbines that start in about a minute and ramp up quickly. The other option is to keep a reserve on the grid, keep large generators rotating under near full power, say 99%. So a 1 GW capacity plant might be working at 990 MW and the last 10 MW are their spinning reserves that can be brought online when needed.

Also, consider large downtown areas, such as NYC. “You cannot get more power into New York because the power cables are working at maximum. More remote areas provide another application. Utilities might consider stringing 100mi of line to feed a couple farms. That could be an expensive commitment especially if the power is needed only for a couple hours a day to handle their peak loads. But a bank of batteries near the loads would defer the need to spend the capital to upgrade the line,” he says.

Of course, costs are key to success. “The DOE suggests a goal of storing power at $200/kWh. This is the wrong approach. The question that should be asked is: What is the levelized cost of energy over 10 to 20 years? Or, what are maintenance costs, the cost of money, efficiency losses, the number of cycles, and replacement costs, because all batteries wear out. Add those up and you discount it back today for a better cost per kWh,” he adds.

For instance, cheap lead-acid batteries from China might cost $100/kWh but last only a year because of the high number of cycles and so must be replaced each year. So the life cost of energy would be high. “Too many focus on whether or not the battery can be made for $100/kWh. That is the wrong approach. In our case, and this applies to all vanadium guys, the design never requires replacing the electrolyte. It will have a low cost of ownership over the life of the battery because you don’t replace 40% of the battery in an upgrade. With this perspective, the vanadium battery is most cost effective.

Other components include electric controls, balance of plant, peripheral equipment, and the packaging. “We think that with this packaging and the footprint, this platform will offer total energy costs of $0.14/kWh, including the generation costs,” says Hennessy. That is competitive on the East coast, but 14¢ in Hawaii is a bargain. Even some places in California, the cost for power is $0.56/kWh.

Smaller companies and businesses might be interested to learn of a new unit that utilities have contrived, the kW-month. “When you connect to the grid, you get a connection rating. For instance, you might have a house with a demand of 10 kW max when you turn on air conditioning, along with all lights and loads. So the utility has to put in a transformer or cable sufficient to supply 10 kW. You pay the utility a connection fee based on the peak kW demand. Then another fee is the demand charge which is dollars/kW-month. So the fee is based on the maximum demand for any portion of an hour in that month. That short peak demand sets the rate for the whole month. You need to hit a peak for only one minute but you pay that rate all month. However, if a company can shave off that peak, it can save a month of peak tariffs. A battery allows such peak shaving.

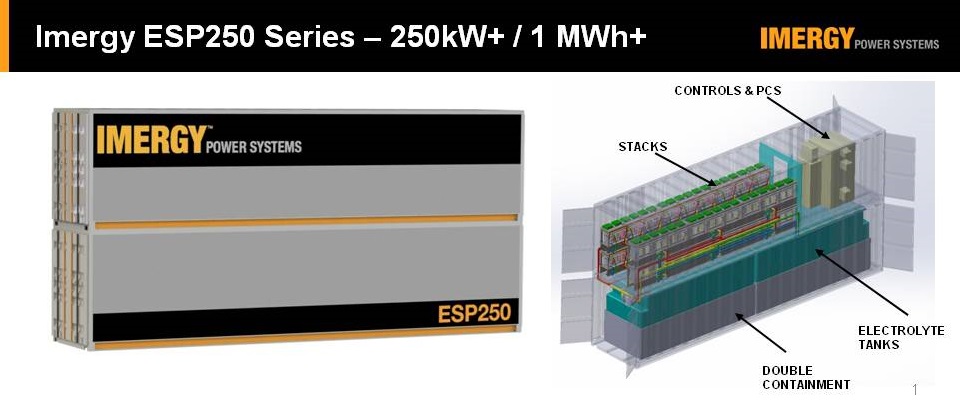

The ESP250 comes in two shipping container for easier transport. Ganging them together provides storage for many megawatts.

Company products so far include the ESP (Energy Storage Platform) 5, 30, and more recently, the 250. The smallest unit, rated for 5 kW, is about the size of a double-wide fridge. It can run a house for about six hours. That platform is intended for residential, communication facilities, and homes on islands. The middle unit provides 30 to 50 kW and addresses small commercial and industrial customers, and microgrids. The newest is the ESP 250 which fits in a 40-ft container, addresses the large scale or utility needs. It can provide 250 kW of power for four hours or 1 MWh of storage. Putting several in parallel provides a MW scale. There are no limits on the number of units that might be ganged. Such a battery would work as a buffer or backup for a wind farm to smooth out wind’s natural variation.

Consider a 10 MW wind farm on Hawaii. A 2 MW battery would let the farm provide smooth power for about 95% of the year. “Flow batteries are well suited to this application because they can make unlimited cycles, from deep discharges to full charges. One such battery installed in Japan operated for three years ago has clocked 360,000 cycles. That is almost impossible for any other technology. What’s more, the controls, similar for wind turbines and variable-speed drives, take 5 ms to signal a switch, or 10 ms to go from max charge to max discharge,” says Hennessy.

Filed Under: Energy storage, News