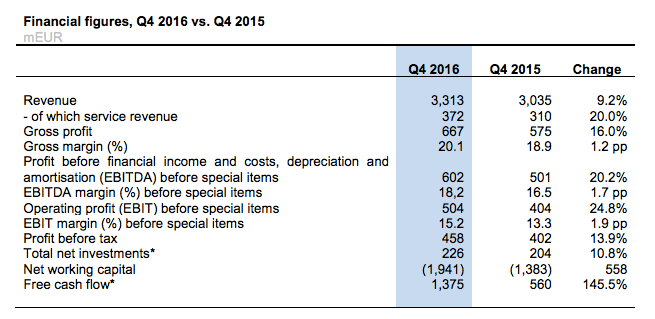

Vestas has released is 2016 annual report with predictions for the year ahead. The company’s turbine order intake increased from 8,943 MW in 2015 to 10,494 MW in 2016, and revenue amounted to EUR $10.2 billion. (Earnings before interest and taxes margin before special items was 13.9%; total net investments were EUR $617 million; and the free cash flow amounted to $1.564 billion.)

The value of the service order backlog increased by EUR $1.8 to $10.7 billion. The activity level and earnings of the period were driven by the stable execution of strong order books for wind turbines and service, both of which continued to grow during the year as a result of solid execution and a favorable market environment.

The fourth quarter of 2016 was characterized by very high levels of activity, and proved to be the largest ever in terms of revenue in Vestas’ history.

“I am extremely pleased with Vestas’ 2016 performance, delivering a record year on revenue, EBIT [before interest and taxes] margin, net profit, free cash flow, order intake, and combined order backlog,” said Anders Runevad, Group President & CEO.

For 2017, Vestas expects revenue to range between $9.25 and $10.25 billion, including service revenue, which is expected to grow. Vestas expects to achieve an EBIT margin before special items of 12to 14%, with the service EBIT margin remaining stable.

Total investments are expected to amount to about $350 million, and the free cash flow is expected to be $700 million at least in 2017.

Deliveries are up more than 29% year-on-year, while costs remained tightly under control,” added Runevad. “All regions contributed to the strong results, demonstrating once again the power of Vestas’ global reach.”

As a result of the strong performance during the year, the Board of Directors recommends to the Annual General Meeting that a dividend of DKK 9.71 per share, compared to DKK 6.82 last year, and equivalent to 30% of the net profit for the year, be distributed to the shareholders.

The expected net proceeds from the sale of the office buildings announced will be distributed to shareholders through a DKK 705m (approx. $95 million) share buy-back program.

Filed Under: Financing, News