This white paper was put together by New Energy Update with insights from these industry experts:

Jim Lanard / CEO / Magellan Wind

Lorry Wagner / President / LEEDCo

Alla Weinstein / Founder and CEO / Trident Winds

Executive summary

After a long and haphazard run-up, the US offshore wind industry finally seems poised to take off. US Secretary of the Interior Ryan Zinke’s endorsement of the sector in April 20181 was perhaps most promising sign so far of a significant project pipeline to come. And as project developers finally get down to business, one of the big questions is: who will fund their efforts? While most experts agree that there should be no shortage of takers, it is still unclear exactly who will be stepping forward and what kinds of deals will be done.

After a long and haphazard run-up, the US offshore wind industry finally seems poised to take off. US Secretary of the Interior Ryan Zinke’s endorsement of the sector in April 20181 was perhaps most promising sign so far of a significant project pipeline to come. And as project developers finally get down to business, one of the big questions is: who will fund their efforts? While most experts agree that there should be no shortage of takers, it is still unclear exactly who will be stepping forward and what kinds of deals will be done.

Against this backdrop, and as a prelude to the June 2018 US Offshore Wind conference and exhibition in Boston, this white paper surveys some of the main features and issues within the US offshore wind financing landscape.

The financing opportunity

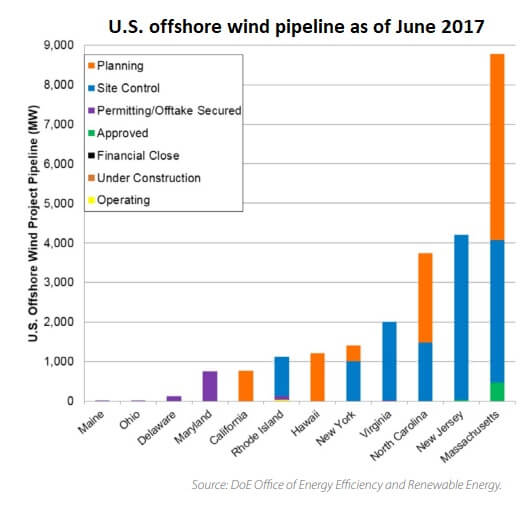

With US renewable energy investment falling 6% in 2017, investors will be heartened by the growing opportunity represented by the offshore wind possibilities off the coast of America. Department of Energy (DoE) data from June 2017 suggests almost 24 GW of capacity. Sources of funding Project funding for offshore is essentially provided by equity holders, which are usually the developers and owners of the projects, and debt providers, traditionally banks. This report also briefly considers the role of federal and state support mechanisms, given the importance that schemes such as the Production Tax Credit (PTC) have had in boosting investor appetite for onshore wind.

The U.S.’ first and only commercial offshore wind farm so far, Deepwater Wind’s Block Island, was funded through a $290 million project financing package provided by Societe Generale of Paris, France, and KeyBank National Association of Cleveland, Ohio. The financing from Societe Generale and KeyBank was in addition to more than $70 million in equity funding provided by Deepwater Wind’s owners, principally an entity of the global investment and technology development firm DE Shaw Group.3city could be built across 28 projects in a dozen states in coming years.

For the rest of article: https://goo.gl/JN5J26

Filed Under: Financing, Offshore wind