Coal still makes up the largest part of China’s energy consumption but that is changing, and quicker than most have anticipated. Earlier this year, the country announced plans to cancel more than 100 coal plants under development, which would have generated 120 GW or so of electricity capacity. Some have suggested that had the coal plants reached completion, China would have had a surplus of power. But if there are concerns about the country’s future energy needs, it seems safe to dismiss them given the current targets and growth rate of renewables.

China is currently planning a 800-MW wind farm off the coast of eastern China’s Yancheng, which will surpass the UK’s 630-MW London Array as the world’s largest offshore wind farm.

Certainly, kudos are in order for the solar photovoltaic market. This summer, China’s solar PV capacity hit the 112-GW mark after the install of 35 GW in just seven months. To give that number perspective, that is more than twice as much the amount of solar PV installed by any other country in all of 2016. It also means total PV capacity now exceeds the Chinese government’s 2020 goal, set just last year.

Near the end of 2016, the National Energy Administration (NEA is responsible for implementing energy development plans and industrial policies) adopted the Chinese government’s 13th Solar Energy Development Five-Year Plan (2016-2020) for 105 GW of solar PV by 2020.

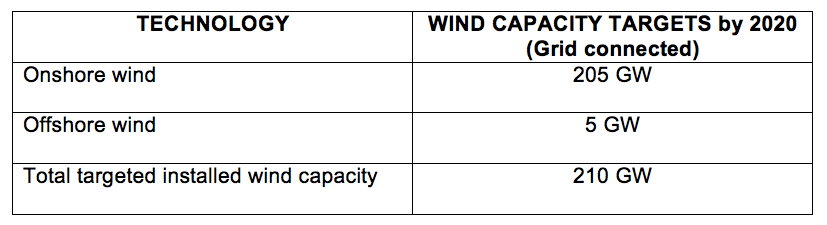

NEA also adopted the Five-Year Plan for wind, with targets as follows.

So while solar is off to a running start, how is wind power fairing? Well, according to one report, China is on track to install at least 110.4 GW of onshore wind capacity over the next three years. This would increase the country’s cumulative installed capacity by 2020 to about 264 GW, far surpassing the original target of 210 GW set during the 13th Five-Year Plan period.

However, analysis from MAKE Consulting suggests that the annual grid-connected capacity from 2017 to 2020 will be less than 25 GW in China, mainly because of curtailment restraints — meaning wind is available but left unused. Curtailment occurs for any number of reasons including grid congestion, oversupply, or operational issues. For example, in 2015, reports suggest that about 15% of China’s wind energy was wasted because of curtailment issues. But this is an issue that may affect solar projects, too, and so far China’s commitment to solar power shows no signs of wavering.

Wind is also expected to make progress offshore. In fact, China’s offshore wind resources are expected to accelerate at a gigawatt-level annually starting in 2018, and MAKE believes it will reach 26 GW by the end of 2026. This makes sense because China is currently on track to build world’s largest offshore wind farm.

State Power Investment Corporation, one of the country’s main power producers, is planning a 800-MW wind farm off the coast of eastern China’s Yancheng, Jiangsu province. If plans proceed, the project will surpass the UK’s 630-MW London Array and nab top spot as the world’s largest offshore wind farm. Yancheng Wind is currently set to enter operation in 2018.

Overall, MAKE’s 10-year wind-power outlook for China consists of steady annual capacity additions from 2017 to 2026, resulting in a cumulative grid-connected capacity of 403 GW by the end of 2026. That’s below China Five-Year wind target. And, given the rate at which the country has added PV to its electric grid, possibly a far too modest prediction. Only time will tell.

For now, fingers are crossed because every ounce of wind power added to the grid is good for the industry, and brings us one step closer to a world powered by clean energy.

Filed Under: News, Offshore wind, Policy, Projects