Vaisala, a global provider of environmental and industrial measurement, has outlined findings that underscore the increasing importance of intelligent project selection for U.S. wind investors, and ways to more realistically set future revenue expectations. Building a genuinely diverse, climate resilient portfolio could reduce the variability and financial impact created by short and long-term weather anomalies.

The findings, which will be shared next week with delegates at AWEA WINDPOWER 2016 in New Orleans, reflect a continued desire among investors and owner-operators to develop balanced project portfolios that yield stable returns. Vaisala’s research also serves as an important reminder of the ever-present risk associated with investing in regional power portfolios, following recent extreme low wind speed events and their subsequent impact on local power output.

The findings, which will be shared next week with delegates at AWEA WINDPOWER 2016 in New Orleans, reflect a continued desire among investors and owner-operators to develop balanced project portfolios that yield stable returns. Vaisala’s research also serves as an important reminder of the ever-present risk associated with investing in regional power portfolios, following recent extreme low wind speed events and their subsequent impact on local power output.

While operators of wind energy projects throughout North America have demonstrated an awareness of the significance of geographical portfolio diversification — that is, deploying assets in a range of different regions in order to mitigate the financial impact of below average wind resource in any single area — widespread underperformance in the U.S. throughout much of 2015 has brought the strategy into question.

In particular, project owners with assets in both Texas and California felt the performance impact of unprecedented low wind speeds across their entire portfolios, creating cash-flow problems and questions about the viability of further investment decisions. With the majority of U.S. operational wind capacity concentrated in a handful of regions, building a portfolio resilient enough to manage the impact of another extreme weather event on this scale poses a considerable challenge.

“Climate resilience continues to be a talking point for the U.S. energy sector, particularly given the impact of recent low wind conditions on investors,” said Matthew Hendrickson, Global Manager of Energy Assessment at Vaisala. “However, there are still questions about how the concept can be implemented and applied to operational and planned asset portfolios.”

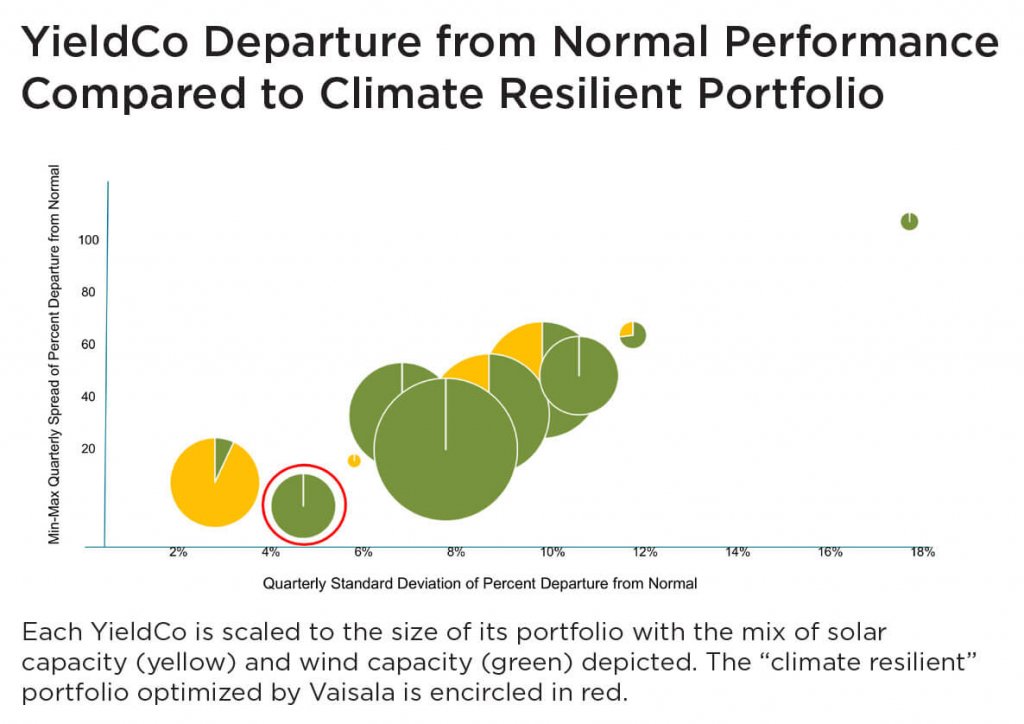

“Looking in-depth at the performance of a number of high-profile YieldCos along with a hypothetical portfolio optimized for climate resilience, we’ve been able to start answering some of the key questions for U.S. project owners. Namely, how much portfolio diversification is possible, given the number of regions usually targeted for wind development? And what is the range of variability achieved by these existing portfolios?”

Vaisala’s Climate Resilience Analysis and approaches to portfolio diversification and revenue forecasting will be discussed in presentations at AWEA WINDPOWER 2016 next week. The company’s research forms part of an ongoing drive to help the U.S. wind industry meet the challenge of maintaining shareholder confidence with steady returns.

“There has been much debate amongst climate scientists about what caused some of the lowest wind speeds on record in California and Texas last year,” said Pascal Storck, Global Manager of Energy Services at Vaisala. “Experts have looked to signals from indices like El Niño and the North Pacific Mode for answers. While useful, these patterns only explain some of the variability. A trusted expert is really necessary to understand climate impacts across a portfolio.”

Critically, based on detailed performance analysis of existing U.S. wind portfolios, Vaisala’s research team has estimated that more effective modeling of weather impacts on production could reduce associated cash flow volatility. A more sophisticated view of portfolio management, considering climate variability as well as other sources of risk, such as turbine technology and measurement campaign design, will ultimately help U.S. investors address the commercial challenge of stabilizing revenues, even in light of highly anomalous weather conditions.

Hendrickson added, “By looking at historical production variability at all existing and potential sites within an investment portfolio, asset managers can correlate the data and assess proposed investment scenarios against internal benchmarks. With this approach it is possible to set a diversification strategy both at a regional and national level in order to balance risk appetites and drive future financial returns.”

On Tuesday, May 24 at AWEA WINDPOWER 2016 in New Orleans, Matthew Hendrickson will be speaking on the subject of “How to Take Advantage of Portfolio Diversity” in the session titled “Topics and Trends in Wind Resource and Energy Assessment” at 2:15 p.m. and Pascal Storck will be presenting “The ‘Godzilla’ El Niño of 2015/2016: Impacts on Wind Energy in North America” at 2:30 p.m.

To receive a copy of the climate resilience findings and to better understand how to reduce portfolio risk and set more realistic revenue expectations, visit Vaisala at booth 1317 or click here to download more information.

Vaisala Energy

www.vaisala.com/energy

Filed Under: Cybersecurity, Financing