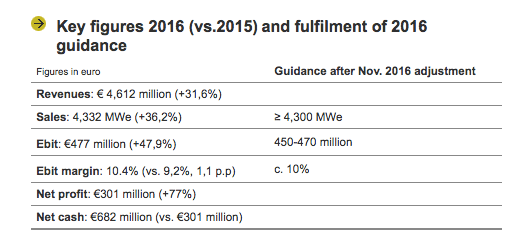

Gamesa obtained €301 million in net profit in 2016 — a 77% increase year-on-year. The wind-turbine manufacturer attributes the growth to higher sales (record revenues of €4,612 million, +31.6%) and rising profitability (with a 10.4% EBIT margin).

The company also concluded 2016 with a record order book, having taken in 4,687 MW in orders in the year, and cash flow (€423 million).

These results met and exceeded the objectives set in the Business Plan 2015-2017 one year ahead of schedule, and also beat the guidance of 2016, which had already been revised upwards twice (in July and November).

These results met and exceeded the objectives set in the Business Plan 2015-2017 one year ahead of schedule, and also beat the guidance of 2016, which had already been revised upwards twice (in July and November).

Sharp increase in commercial activity

Gamesa increased revenues by 31.6% in 2016, to €4,612 million, driven by growth in revenues in the wind-turbine area (+37%), as a result of higher activity, which amounted to 4,332 MWe, 36.2% more than in 2015.

Sales (MWe) were evenly distributed worldwide, though led by India (38%) and Latin America (24%). EMEA, the U.S. and Asia-Pacific accounted for 17%, 12% and 9%, respectively.

This good competitive position supports Gamesa’s commercial strength, since order intake amounted to 4,687 MW in 2016, of which 1,386 MW were signed in the fourth quarter (+33%). The pipeline secures 63% coverage of the sales guidance for 2017 (c. 5,000 MWe).

The G114-2.0 MW-2.5 MW and G126-2.5 MW models gained in importance in orders, from 50% in 2015 to 67% in 2016. Considering also the first contract for the G132-3.465 MW generator, new models accounted for 70% of order intake.

As a result, after installing 4,300 MW in the year, Gamesa has increased its market share to rank fourth in the global league table of wind-turbine manufacturers published by FTI Consulting and also in the Bloomberg New Energy Finance (BNEF) ranking.

Operation and maintenance (O&M) revenues were stable, at €471 million in 2016, while profitability improved significantly.

Improved profitability

In 2016, Gamesa continued to work on optimising variable expenses, controlling structural costs and implementing quality excellence programmes. As a result, EBIT increased by 48% to €477 million, i.e. an EBIT margin of 10.4%, while net profit amounted to €301 million (+77%).

The sound balance sheet is another of the pillars supporting the company’s strategy. Gamesa reported record cash flow, €423 million, enabling it to end the year with a net cash position of €682 million (€301 million at 2015 year-end).

Prospects for 2017: commitment to value creation

In addition to surpassing its financial goals for the year, during 2016 Gamesa made strong progress with its long-term strategy by reaching an agreement to merge with Siemens Wind Power to create a world leader in the wind-power industry. The deal is still scheduled for completion in April.

Based on year-end estimates, the merged company will be the largest in the market in terms of order backlog (€20,900 million), and revenues (about €11,000 million combined). Its adjusted EBIT will be about €1,058 million, with an EBIT margin of 9.6%.

Meanwhile, Gamesa continues to advance with its business plan, having set new goals for 2017: the company expects around 15%3 growth in volume (the commitment is to reach 5,000 MWe) and operating profit: €550 million in EBIT and an EBIT margin of 10 to 11%.

Filed Under: Financing