By Michelle Froese, Senior editor

Windpower Engineering & Development

Life as a wind developer is far more challenging today than in previous years. Granted, the work has always been a complex process that involves many steps, including land prospecting, permitting, financing, designing, constructing, and many others. However, the current market landscape is unlike any other the wind industry has seen before, with fewer power-purchase agreements (PPA) and expiring production tax credits (PTC).

The investment risks are greater and a seemingly good, strong-wind location is no guarantee of a profitable return on investment for a wind project. Unlike good real-estate catchphrase, “location, location, location,” nothing similar applies to the current wind industry.

The phase-out of Production Tax Credits (PTC) over the next few years will reshape the geography of wind development. As the PTC winds down and power-purchase agreements become less available, developers will have to consider other market factors in siting of wind, and this means the criteria for finding the best sites for wind projects will change.

“It used to be that a developer would find where the wind is blowing and, assuming it was blowing consistently well, would build a project there,” explains Erik Olbeter, Managing Director of ICF, a global consulting and technology services provider. “There was little risk throughout the entire project. Offtake agreements were standard. It was fairly easy to get a long-term PPA in place. So, it mainly came down to this: if you had good wind at a project site, you knew that you were going to be OK.”

An offtake agreement is a contract negotiated between a developer (or seller) and power purchaser, typically negotiated prior to a project’s construction. In the case of a wind project, it secures a minimum level of return for the power, lowering the risk of the investment. A PPA is an agreement that outlines the terms of sale for the power between the buyer and seller, such as start of project operation and the length of the contract.

Olbeter says times have changed in the industry. Energy costs are more volatile and less certain, and contracts are more challenging to negotiate. “The current marketplace for wind projects has far fewer PPAs, so there is a lot more risk for the offtaker. That means simply knowing where winds are blowing is no longer enough.”

Part of the reason for this is the expiring PTC. The tax credits, extended through 2019, have begun phasing down by 20% each year beginning in 2017. This means projects have to get done quickly to qualify and meet the deadline.

“A wind assessment, while still important, is no longer the key to a successful project. It’s not enough to qualify risk,” Olbeter says. “There is now a fairly short window to get things done, so developers need to be savvy about how their wind resource interacts with energy market pricing and congestion.” Power grid congestion occurs when there is insufficient energy to meet the demands of customers.

The aging transmission grid is another reason risks are higher than before. “When negotiating wind development, congestion and curtailment become much more substantial issues than they have ever been in the past,” he says.

Congestion, curtailment & costs

In a recent study, the National Renewable Energy Lab (NREL) found that the U.S. would need to build 33,000 circuit miles of new transmission lines (at a cost of $60 billion) to support the aggressive wind growth strategy of 35% wind penetration by 2050, as set out in the Department of Energy’s 2015 Wind Vision Study. NREL analysis of the Plains & Eastern transmission project alone, found that curtailment of wind-power generation could be reduced by around half to 7.8% by building four proposed transmission lines of combined capacity 10.5 GW.

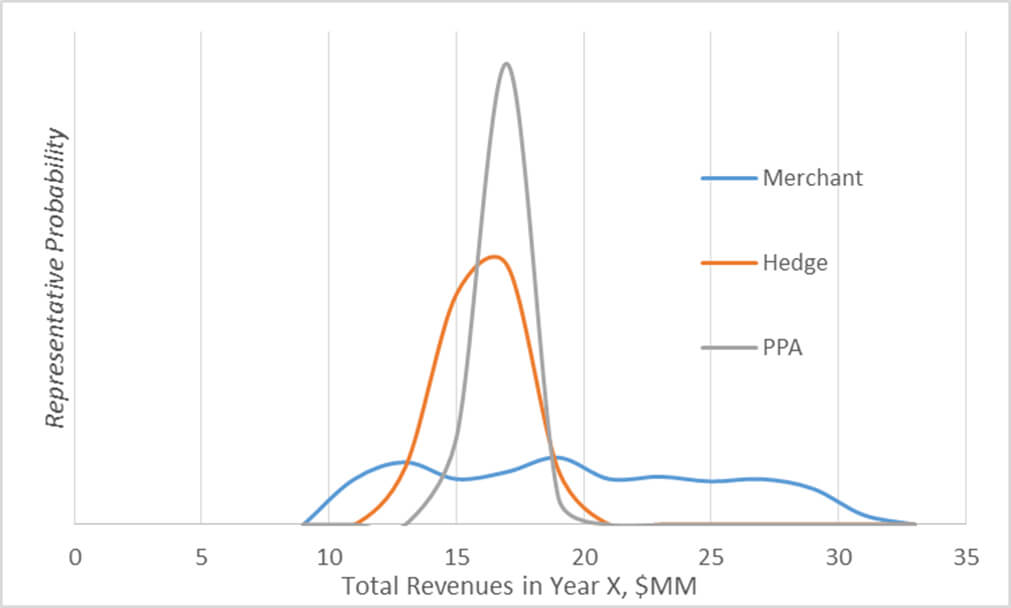

Wind-energy developers face different challenges depending on how they sell their power. As the graph shows, hedges seek to strike the middle ground in terms of risk between power-purchase agreements (PPAs) and the merchant. A hedge is an investment that reduces the risk of adverse price movements for an asset.

Curtailment occurs for any number of reasons including local congestion, oversupply, or operational issues. Grid congestion occurs when there is more generation (from wind and others) than there is available transmission or distribution capacity to move the power through the grid to load centers. A good example of this is in Texas, where there are excellent wind resources and more limited transmission capacity.

“In other words, the largest wind resource in a developer’s portfolio may not be the greatest asset,” he says. “Potential curtailment concerns lead to questions that investors are now asking before considering any contract: how does power generation coincide with energy demand and costs?”

Olbeter explains that the same developer may have in his or her portfolio a much lower wind resource of, say only 30 or 35% generation capacity, but that wind is consistently blowing at a time when people use power the most. “So, for example, a Michigan wind project might fair better than a Panhandle project, even though the Panhandle may have a 50% or higher capacity factor. Why? Because the Panhandle is producing power at times when prices are at their lowest.”

This means the wind is weak or absent during peak demand times. “But in Michigan, the wind might pickup when more people are using more power. So, it’s a far more valuable resource, and puts less stress on transmission systems and grid operators.” He adds that this type of insight is now extremely important to new contracts. “And it can offer some new ideas on where and which wind farms will get built in the future.”

Delving into detail

So how do developers navigate today’s wind market and locate the best potential project sites when a strong wind resource fails to guarantee success? “Analytics,” Olbeter says. “Upfront and very responsive analytics can provide direction to wind developers and guide them as to where they can best spend their time.”

Basically, the devil is in the details when it comes to successful wind development in the current market. Case in point: a wind project could be curtailed five percent of the time, but perhaps it is in the middle of the night when power demand is low so it’s worth next to nothing. The scenario can lead to a much different result than when the reverse is true.

“We found that we get better predictions when we consider cost for power, congestion constraints, and the wind resource simultaneously,” says Olbeter. “This multi-dimensional analysis lets a developer anticipate the margins on a hedge and puts them in an advantageous position.”

Hedge agreements, which are becoming more typical in the wind industry, aim to offset the risk of adverse costs or expected energy changes. Hedges typically rely upon a set cost or “strike price” per kilowatt-hour of energy produced by a wind farm, which is negotiated between a developer or wind-farm owner and a power purchaser or utility. It is a type of middle-ground agreement that accounts for the variability of power produced and cost certainty. So, should the market cost for energy decrease at the time of sale, the hedge provider pays the difference, and vice versa.

There are two main points of risk for developers related to hedges. Olbeter explains: “The first is called basis risk, which represents the potential difference in price between the node and hub.” The nod is where a project connects to the gird, and the hub is where power is liquidated and sold. “The price between the two locations can vary significantly, and is typically due to transmission constraints on the system such as congestion.”

The price difference means that if power is sold at the node for $20 but the hub is trading at $30, then a developer somehow needs to make up that difference. “The ability to get to reach the hub price raises risk levels for wind developers because there is uncertainty between where and when power is placed on the grid, and where and when it’s getting to that liquid hub,” he adds.

The second point relates to how much wind will be generated. Wind resources are typically evaluated on a probability scale between a P50 and a P95, or P99, which is the probability of hitting a particular power production. “Banks or investors may commit to P90 or P95, but most likely it will be a conservative level of the predicted output. This introduces another form of risk called volume risk. It leaves a developer with a portion of wind uncovered by a contract, which potentially makes financing more challenging.”

ICF has advised clients on hedges and found ways to reduce downside risk by up to 20% and improve expected upside by 5%. “Good analytics can improve expected return, and reduce overall risk by changing even just a few hours of committed power over the course of a year — which can potentially make an uneconomic project viable,” he says.

A successful developer typically includes inputs for congestion and curtailment, and recognizes that neither are a cause for dispositive circumstances. “So just because a project come with certain constraints or some curtailment does not necessarily devalue the wind farm. Such events must be understood within their proper context. And good analytics can assist wind projects in getting built and generating revenue to full capacity,” Olbeter says.

Filed Under: Financing, News, Policy