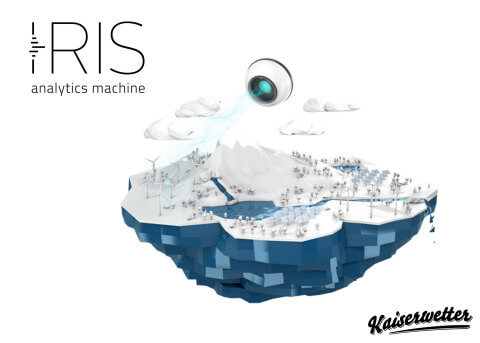

Kaiserwetter Energy Asset Management has launched IRIS, an energy IntelliTech innovation, to significantly reduce the time and cost of wind energy M&A transactions. The company will be demoing the data intelligence service along with its ARISTOTELES platform at REFF-Wall Street 2019 in New York City this week.

IRIS uses proprietary algorithms and smart data analytics to quickly produce detailed due diligence reports that identify and assess asset risks and performance.

IRIS uses proprietary algorithms and smart data analytics to quickly produce detailed due diligence reports that identify and assess asset risks and performance. By digitizing this process, IRIS can produce these reports in five days or less, lowering transaction cost, and expediting asset valuation and deal closing.

“Traditional due diligence reports for wind energy deals can take five weeks or more, but IRIS can produce more detailed and accurate reports in a matter of days,” said Martin Kornemann, chief data officer at Kaiserwetter. “This is a real game changer for wind energy M&A work.”

Last year was a banner year for renewable energy M&A transactions in the U.S. In 2018, 9,855 MW of wind energy were sold, according to FTI Consulting. With the impending production tax credit (PTC) cliff, experts believe that there will be a significant increase in onshore wind M&A activity through 2020.

Making the due diligence process for wind deals easier, more efficient and informative, IRIS’s reports include asset health status information, energy production insights, performance analytics, meteorological analysis, temperature analytics and data quality information.

One of the unique and most valuable portions of IRIS’s report is the potential analysis—an assessment of the possible increase in asset performance (potential gain). Regarded as a “magic number” for the entire investment cycle, the analysis shows the potential that exists from a technical perspective for improving investment return.

In addition to providing data intelligence for M&A transactions, IRIS can also create status reports for asset holders, financing banks, and rating agencies of wind farms who are looking for comprehensive information regarding performance and technical conditions at any given point in time.

When the reports are created on a regular basis, they can help these clients develop an independent and data-based perspective on the wind farm. These periodic status reports can give investors certainty regarding long-term performance, especially when it comes to asset-based capital market products (e.g. bonds). These reports can also help detect the causes for underperforming assets and identify weak spots.

IRIS is the first technology outgrowth of ARISTOTELES, a cloud-based IoT platform performing Data Analytics as a Service (DAaaS) launched in 2017. Developed in partnership with SAP, ARISTOTELES turns complex and unstructured technical and financial data into valuable and actionable real-time intelligence for investors and financial institutions to minimize investment and lending risks and maximize monetary returns and cash flows.

“IRIS is a natural extension of our ARISTOTELES platform, and like that platform, it will help catalyze investment into renewable energy,” said Hanno Schoklitsch, CEO of Kaiserwetter. “IRIS will save investors, sellers, financing banks, rating agencies and M&A consultants valuable time and money.”

Filed Under: Financing, News, Software