AWEA CEO, Tom Kiernan.

“What a difference a year makes.” That was the first comment from Tom Kiernan, CEO of the American Wind Energy Association (AWEA), during his opening presentation at the organization’s recent Wind Energy Finance & Investment Conference in New York. Last year at this time, uncertainty was the word typically used to describe the wind industry.

“No one could predict the future and whether the production tax credits would be renewed — and, if so, for how long,” he said. “Would it be for one year, five years, no years? No one knew for sure.”

The uncertainty made it tough for investors and developers to plan for future wind projects. The PTC is a federal incentive that provides financial support for the development of renewable energy facilities. Since 2008, it has helped drive down the cost of wind by 66% and more than triple wind power in the U.S. But it was set to expire at the end of 2015.

“This year, we have certainty: a five-year extension with a phase-down and a four-year guidance from the IRS. And the result?” he asked. “The country now has 18,000 MW under or nearing construction, which is close to a record number. Things are really rocking for wind power.”

Kiernan gave full credit to those in the industry and offered special thanks to wind advocates, companies, and AWEA members who helped educate Congress on the significance of wind energy and what it needs for continued success. He also credited investors who’ve spent $120 billion in the wind industry over the last 10 years.

“That support has allowed the industry to grow to a total of 75,000 MW of installed capacity this year,” he said “Wind makes up five percent of all U.S. generating power and, given the capacity we have under construction, we should be at 10% of electrical generation by 2020. That’s right on track with the Department of Energy’s Wind Vision.”

The Wind Vision report maintains that wind power could double in the next four years and supply 20% of U.S. electricity needs by 2030. The report also shows that wind could be a viable source of renewable electricity in all 50 states by 2050. In this scenario, consumer savings are projected to reach $14 billion a year by 2050, with cumulative savings on electricity bills reaching $149 billion.

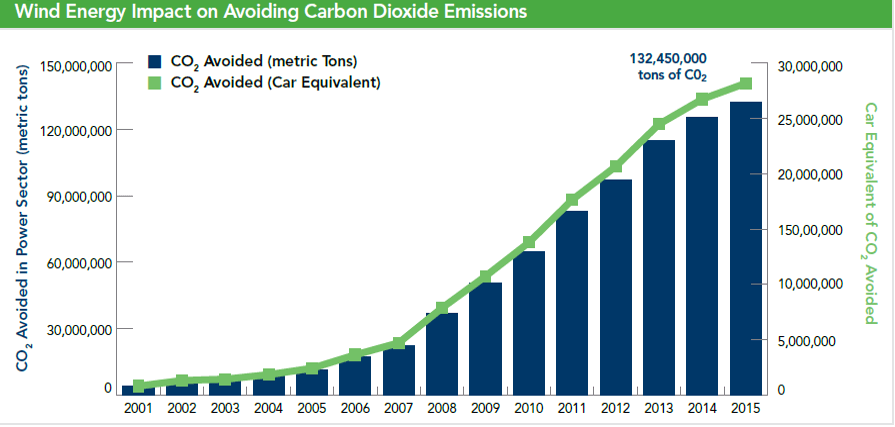

Each new wind turbine typically avoids over 4,200 metric tons of carbon dioxide (CO2) a year, (equal to nearly 900 cars’ worth). Wind energy also reduces a variety of health-harming air pollutants, including smog-causing sulfur dioxide, and nitrogen oxides. (Source: AWEA U.S. Wind Industry Annual Market Report Year Ending 2015)

Wind power already provides nine states with 12% or more of their annual electricity production, and Iowa, South Dakota, and Kansas source more than 20% of their annual electricity from wind. Kiernan pointed out that Texas has also seen wind reliably meet over 40% of its electricity needs and in Colorado wind has at times contributed to over 65% of the state’s power.

“A large reason for this exponential growth in wind energy comes from purchasers. It’s no longer just high-tech companies, such as Google or Facebook, that are buying wind power but also mainstream companies, such as Wal-Mart, Proctor & Gamble, and Dow Chemical,” he said. Major brands and other non-utility customers signed 52% of the wind-power capacity contracted through power purchase agreements in 2015.

So, why are these companies investing in wind? “Sure, it’s affordable, reliable, renewable, and provides years of stable pricing,” said Kiernan. “But mostly these companies are buying wind power because it makes good business and financial sense for them.”

He added that this is an important message to share with communities throughout the U.S. — and with Congress. “While we have the phase-down support of the PTC right now, we have to plan beyond the next four years and into 2020.” Kiernan said it is important to ensure the strong momentum wind power has gained doesn’t fade out with the PTC. “We don’t want a boom-and-bust cycle but long-term stable policies, pricing, and clean power. It is also important for the Clean Power Plan,” he added.

The Clean Power Plan (CPP) offers guidelines for reducing carbon pollution from power plants and acting on climate change. It is currently undergoing appeals because of a Supreme Court stay.

“We feel strongly that the Clean Power Plan will eventually move forward,” Kiernan said. “When you look at the geography of where wind power is strong and CO2 emissions have been reduced, it maps well with what states we still need to get onboard to comply with the CCP.”

In 2015, the 191 million megawatt-hours generated by wind energy avoided an estimated 132 million metric tons of CO2, the equivalent of reducing the emissions of 28.1 million cars.

If proof is needed that the CPP’s goal is attainable, Kiernan said to look to the Department of Energy’s report released last year that states wind power is the biggest, fastest, and cheapest means to carbon reduction. “Of course, there is still a lot of work to be done. When you look at the windiest part of the country and where transmission lines are installed, we have to develop better integration to ensure wind power can cost-effectively come online.”

Access to sufficient transmission infrastructure will be an important catalyst for future growth of wind energy and reduced carbon emissions. “That’s where education continues to come into play and why stable policies are needed to get the full potential of wind power to customers,” he said.

Fortunately, regional grid operators such as PJM, part of the Eastern Interconnect, have indicated that they plan to proceed with the Clean Power Plan regardless of the current stay. With wind energy costs at an all-time low, demand remains strong for this clean-energy source.

While we are only part way through the month, Kiernan pointed to the month of October as an example of wind power’s success and future potential. “Based on the number of contracts written and turbines supplied, it looks like October will result in the biggest month ever for the wind industry. We’ll have to wait to see for sure. But it’s an exciting time for wind in the U.S. and essential we keep up the momentum.”

Filed Under: Financing, News, Policy