FTI Consulting, a global business advisory firm, has released its preliminary rankings for the world’s top five wind turbine original equipment manufacturers (“OEMs”). These rankings are to be published in the Global Wind Market Update ― Demand & Supply 2014, which will be officially released in March 2015. The report is authored by members of the FTI-CL Energy practice, a cross-practice team of energy experts from both FTI Consulting and its subsidiary, Compass Lexecon. Preliminary results are subject to change between now and the release date of the actual report.

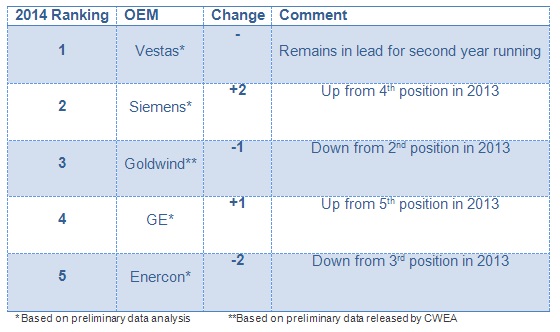

Vestas holds the top spot in the preliminary rankings as the leading turbine OEM. Siemens is at second place for 2014. At this time, FTI Intelligence assigns the following OEM market rankings.

Preliminary rankings highlights from 2014:

- All top 10 turbine OEMs break individual installation records in 2014, in what was the highest installation year for the wind industry.

- Vestas holds the #1 position, with a significant margin over competition.

- Siemens had a record breaking year for its onshore business.

- Goldwind holds the #3 position behind Siemens, but remains the largest turbine OEM in Asia.

- In 2014, GE nearly doubled installations and now holds the #4 position.

- Despite another strong year with respect to installs for Enercon, other OEMs outperformed on the international arena, and Enercon holds the #5 position.

- Gamesa remains out of the top five despite a healthy uplift in its business after a challenging domestic market.

- Suzlon Group relied on the growth of its home market and Senvion`s strong performance in Germany to attain a position of #6.

- Nordex is not in the top 10 despite another strong performance in its core markets that saw an uplift of nearly 20% in business.

- Two Chinese companies: United Power and Mingyang are in the top 10. Although, Sinovel dropped out of the top 15 in 2014, as a rising star Envision moved into the top 10 for the first time.

Preliminary findings in the Global Wind Market Update – Demand & Supply 2014:

- Global wind capacity bounced back with more than 50GW in 2014, over 40% growth on 2013. This was mainly driven by a record breaking growth in China, Germany and Brazil.

- The interim offshore wind feed-in tariff (“FiT”) released in China in June 2014 provided the guideline for projects commissioned before 2017, but concerns about the proposed reduction of the country’s onshore wind FiT by the end of June 2015 created a market rush.

- In October, EU leaders committed to reduce greenhouse gas emissions by at least 40% by 2030, increasing energy efficiency and renewables by at least 27%, lower than the earlier goal of 30% that is not legally binding at the national level.

- President Barack Obama and Xi Jinping signed an agreement to combat climate change by cutting carbon emissions. The U.S. pledge to cut carbon pollution to 26-28% below 2005 levels by 2024, and Chinese pledge that 20% of its energy will come from low-carbon source by 2030, bring climate change back higher on the public and political agenda.

- In December, the U.S. Senate approved an extension for the Production Tax Credit (“PTC”) for wind through the end of 2014, leaving little time to boost new project development. The U.S. wind market may collapse again in 2016 if the PTC is not renewed early in 2015.

- At a broader policy level, the wind industry continues to see a transition away from fixed FiTs and towards more market-reflective support mechanisms in 2014. The latest revision of the renewable energy legislation in Germany and Poland are a few key examples.

- Low wholesale electricity prices, prompted by overcapacity in generation and sluggish demand across the continent, have forced a number of European-based utilities to cut back offshore plans in 2014. Divesting stakes in onshore and offshore wind projects have enabled capital to be “recycled” and has become a mainstream strategy.

- In search of low cost capital, the wind industry has seen a steady drumbeat of yieldco initial public offerings from major wind farm operators on both sides of the Atlantic. Several large deals in 2014 reflect the growing dominance of yieldcos in the M&A market.

- Consolidation among turbine manufacturers has been a strong feature in 2014. Following the offshore wind joint venture signed between Vestas and Mitsubishi, Gamesa and Areva signed binding agreements for the creation of a joint venture in the offshore section in July 2014. In November, the French government approved the proposed take-over of Alstom’s power division by GE, which brings GE back to the offshore wind sector.

- The global wind industry has become leaner and more flexible to change, having seen the shake out of a quarter of businesses from the wind market and OEMs focusing on platform based turbine development.

The Global Wind Market Update ― Demand & Supply 2014 report will comprise over 175 pages, with more than 60 tables, charts and graphs illustrating the development in the global wind market. It will present FTI Intelligence’s latest market forecasts for 2015-2020 and a view of the market by 2025.

“2014 was a record year for the wind industry, but it was mainly driven by the boom- and bust fear created by the regulatory uncertainty in China and Germany,” explained Feng Zhao, Director at FTI Consulting and Head of Wind Energy within the FTI-CL Energy practice. “Although the growth in South and East Asia, and Latin America will remain strong, without a stable market structure in Europe and the policy consistency in the U.S., the global wind market is likely to fall in 2016.”

“The wind industry has been through a major overhaul shaking out a quarter of businesses across the supply chain, combined with a shift away from FiT-based market mechanisms. Despite the industry showing its resilience and ability to adapt, the record 50GW installations disguise the underlying challenges facing the industry,” says Aris Karcanias, Managing Director at FTI Consulting and Co-Lead of the Company’s FTI-CL Clean Tech practice.

The report is authored by members of the FTI-CL Energy practice, a cross-practice team of energy experts from both FTI Consulting and its subsidiary, Compass Lexecon. The views expressed in this piece are those of the authors and are not necessarily the views of FTI Consulting, its other professionals, its management or its subsidiaries and affiliates. For more information on the FTI Intelligence Global Wind Market Update – Demand & Supply 2014 report please contact Feng Zhao at feng.zhao@fticonsulting.com or Aris Karcanias ataris.karcanias@fticonsulting.com.

Filed Under: News