National and multilateral development banks are key to scaling up clean energy investment to at least $1 trillion per year, according to a new paper released ahead of the World Bank-IMF Spring Meetings.

Investing at Least a Trillion Dollars a Year in Clean Energy, from the New Climate Economy, explores different policies and instruments for reducing financing costs. It finds that cooperation among multilateral development banks (MDBs), govern ments, and the private sector can lower the risk of clean energy investments and lower the cost of capital.

ments, and the private sector can lower the risk of clean energy investments and lower the cost of capital.

“Everyone knows that we need to invest more in clean energy,” said Helen Mountford, Program Director of the New Climate Economy. “What we need to recognize is that the capital is already available. Investors are on the hunt for new opportunities. We need to scale up risk mitigation approaches to match the risk-return profile that they need, and the money will pour in.”

Development banks can take on the risks that no other actors are willing to take. The paper recommends that they expand their risk mitigation instruments and increase their direct investment in clean energy projects. For every US$1 the MDBs invest, they can leverage up to US$20 in private finance. Meanwhile, new financing vehicles like green bonds and YieldCos are growing rapidly, and can reduce liquidity risk for investors.

“Clean energy projects face financing models and electricity markets designed for fossil fuels,” said Ilmi Granoff, co-author of the paper and Senior Research Associate at the Overseas Development Institute, “but renewables have no fuel costs, low operating costs, and can be flexibly deployed—we need to change the paradigm so that clean energy assets are priced to reflect their low risk.”

If clean energy projects could access low-cost, long-term financing, the cost of clean electricity could be reduced by as much as 20% in developed economies and the cost of clean energy support could be reduced by as much as 30% in emerging economies.

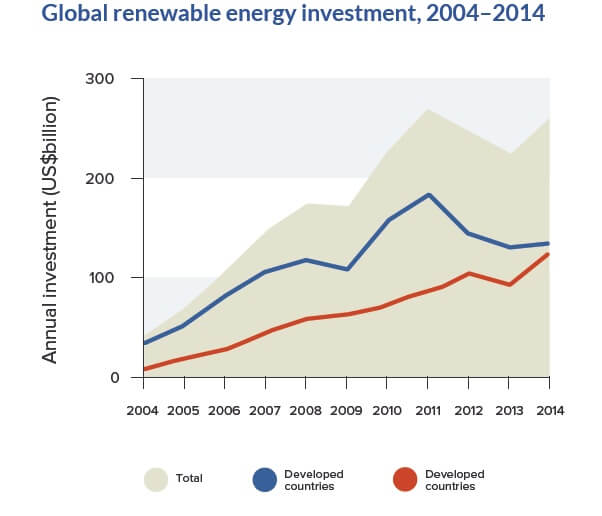

In 2015, clean energy attracted US$329 billion in global investment, a new record but still not enough to limit global warming below 2°C or provide energy access to the 1.1 billion people who lack it.

The paper also finds that scaling up investment in clean energy and energy efficiency to US$1 trillion per year by 2030 could reduce annual GHG emissions by up to 7.5 Gt CO2e, more than the annual emissions of the United States.

“Clean energy investment is potentially a massive triple win for the economy, the climate, and for rapidly achieving energy access,” said Mountford.

Filed Under: Financing, News