Authors Caileen Kateri Gamache, Deanne M. Barrow, Ken Collison, and Shankar Chandramowli with ICF in Fairfax, Virginia

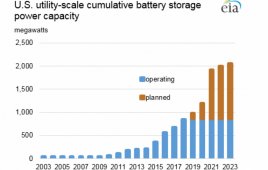

Deployment of energy storage, especially batteries, will increase substantially in the next few years.

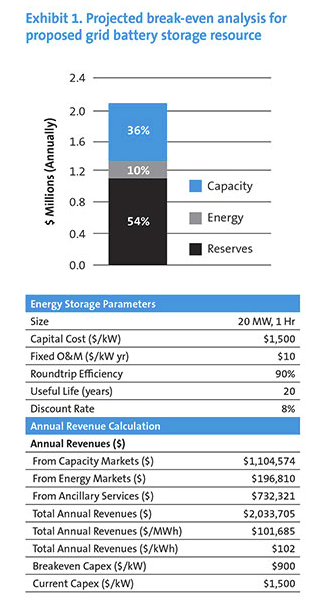

Three underlying trends in the energy markets will drive the growth. They are favorable federal and state regulations on energy storage, falling costs for batteries due to advances in technologies, and an improved ability by energy storage owners to tap into multiple revenue streams.

However, as with any novel technology, the array of opportunities for storage brings new types of risks. Project developers and investors need to understand the risks so that they can plan for contingencies and mitigate risks.

However, as with any novel technology, the array of opportunities for storage brings new types of risks. Project developers and investors need to understand the risks so that they can plan for contingencies and mitigate risks.

This article describes changes in the market that are driving deployment and improving the economics of storage and then identifies unique risks for storage projects and how participants in such projects can mitigate the risks.

Regulatory drivers

The storage market is poised for exponential growth. By 2022, Greentech Media is projecting an annual market of 2,600 megawatts, which is nearly 12 times the size of the 2016 market.

New market rules will enable owners of energy storage systems to earn revenue from a growing number of sources, such as deferred transmission and distribution upgrades, integration of intermittent resources, reduced demand or increased generating capacity to address peak load, the provision of ancillary services, and enhanced grid reliability and resiliency.

Until recently, storage was a square peg jammed into the round hole of historic regulation.

The existing federal regulation of wholesale power sales and transmission in interstate commerce was designed for a world largely devoid of any significant energy storage. Although pumped-storage hydroelectricity has been around for a long time, it has very different characteristics from modern storage technologies such as batteries, flywheels or thermal energy storage projects.

Federal and state governments are moving to encourage storage. Storage has benefited at the federal level from targeted loan and incentive programs offered by the US Department of Energy and from efforts by the Federal Energy Regulatory Commission to clear a path to wholesale market participation.

FERC has issued four orders in recent years that help energy storage. It also issued a notice of proposed rulemaking, or NOPR, in November 2016 proposing transparent market rules for energy storage facilities to participate in organized markets run by regional transmission organizations (RTOs) and independent system operators (ISOs). If the NOPR is adopted as proposed, storage would be eligible to provide all capacity, energy and ancillary services in such markets. The problem storage faces trying to participate in such markets today is the rules were developed for power plants and demand response companies and may unnecessarily limit the scope (and therefore compensation) of storage services. Most comments received by FERC in response to the NOPR were favorable — the comment window closed in February 2017 — but the proceeding was placed on hold while FERC sat without a quorum for much of 2017. It remains to be seen whether the newly-reconstituted commission will pursue the NOPR.

For the rest: https://goo.gl/A8dq1i

Filed Under: Energy storage