Wind turbines are typically designed for a 20 year life. The decision to operate a turbine past its design life is not without pros and cons. Keeping a turbine in extended operation equates to increased revenue, but also means higher O&M costs and a greater risk of structural failures. These failures are almost always costly, not to mention the corresponding safety risks. A low-risk alternative is to decommission the turbine at the end of its design life. The downside is that this action delivers no additional financial returns. Wind energy consultant, DNV KEMA, says taking a risk-based approach to life extension can limit exposure to catastrophic failures and provide attractive financial returns.

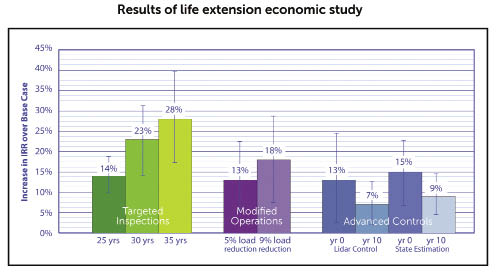

Under sponsorship by EPRI1, DNV KEMA has developed cost models for three life-extension methods and compared the internal rate of return (IRR) against a base case of a 20-year life. The three approaches were targeted inspections, modified operations, and advanced controls. The modeling approaches considered the costs and revenue over the life of the turbines, including the cost of preventing or predicting structural fatigue failure, and the cost of normal component wear out. The turbines were evaluated for extended lifespans of 22 to 35 years, depending on the approach.

“Taking an intentional, careful approach to extending life can prove to be quite profitable for wind farm owners,” says Darrell Stovall, Principal Engineer at DNV KEMA, “Using inspections to inform decisions about when and what to repair, replace or decommission proved to be the most attractive approach to life extension in this study.”

In the targeted inspections approach, structural components are regularly inspected for cracks to predict structural failure. Inspections cost about $6,300 annually per turbine, plus the cost of downtime. The model assumes decommissioning for turbines where cracks were present in the tower, foundation, mainframe, or hub, but replacement of cracked blades.

The modified operations approach can be used to reduce loads by derating or curtailing during high loading events. The benefits were modeled as a 5% to 9% reduction in design-driving fatigue loads at the expense of 1% to 3% annual energy production loss. The model assumes operations are modified over the entire life of the turbines.

The bar charts show percent increase in IRR for various approaches to life extension over decommissioning at 20 years.

An advanced controls approach can also reduce turbine loads over those experienced under nominal or older control schemes. The model considers two control options: lidar-based control and state estimation, a purely algorithm-based control approach. Lidar-based control requires a capital investment for the lidar device (estimated at $120,000 per turbine) plus annual O&M costs. A synthesis of available literature yielded an 8% reduction in design-driving loads with lidar-based control and 4% with state estimation, which is an advanced controls technique that is uses algorithms to estimate parameters of the turbine. The model considers each approach for two subcases: implementation in year zero of a wind farm life and implementation in year 10.

For all three approaches, the results show an increase in IRR over the base case of decommissioning at year 20. Although the approaches were modeled separately, greater benefits may be achieved through combining approaches. The major findings are:

- The scenarios with the most years of life extension yield the largest financial benefit. Even a few extra years of life extension can increase IRR over the base case.

- Life extension through targeted inspections shows the largest financial gains. Additionally, this measure can be undertaken later in life, while measures to reduce loads must be initiated early to have a noticeable impact.

Taking a risk-based approach to life extension can offer an attractive compromise between the potential for increased revenue and the potential for increased financial and safety risks. DNV KEMA studied three such approaches and found all have the potential to yield higher returns than decommissioning at year 20, with targeted inspections showing the greatest potential. The results are dependent on the assumptions of the model and in application the best approach to life extension will be site and owner specific. Before undertaking a campaign to extend turbine life, DNV KEMA recommends considering an analysis of consumed fatigue life. WPE

1. EPRI Report # 1024004 Sept 2012 available at www.epri.com

Alex Byrne

Senior Engineer

Turbine Technology

DNV KEMA

www.dnvkema.com

Filed Under: Featured, News

Could you please tell me which Revenues Scheme/PPA Assumptions you have considered with respect to Wind Farm Life Time (as extended thanks to the different approaches)?

Thanks

Michele

Hello Alex,

First off, very interesting paper. I am currently writing a master’s thesis about this very topic – the lifetime extension of turbines.

I have a question about the results:

In the plot you have shown that the IRR will increase for the target inspection the longer the turbine’s life can be extended (14% for 20 years, 23% for 25 years, etc). Correct me if I am wrong: an IRR of 14% means that after one year one gets back 14% of the investment cost. How is it then that the IRR will vary depending on how long the turbine’s life is extended. Should it not remain relatively constant, giving back 14% annually? The only reason i believe this could happen is if the operating cost of the turbine will decrease with time. Surely the opposite is the case, especially during the extended operating life.

Thanks in advance for your time and effort,

Best regards

Thank you for your posting.

In response to your question:

State estimation is purely algorithmic; since there is no hardware, there is no need for modifying O&M costs associated with the control system itself. Lidar based controls require a lidar device and associated hardware and thus both capital and O&M costs were considered for the lidar control system itself. Additionally, it was assumed that certain components are loaded more heavily, such as the pitch system which sees an increase in duty cycle associated with more pitching action, while others are more lightly loaded, as shown in various research papers. These were considered in the O&M cost estimation for the analysis.

In response to your comments:

You are correct; the targeted inspections approach is most profitable, as you will see in the bar chart above. However, with respect to your operational modifications comments: operations can be modified as desired by the operator. The modified operations scenario was interesting precisely because reducing energy production under certain inflow extends useful life by enough years that the net present value increases. In other words, the value of the extra energy produced in years past 20 is greater than the lost value of the energy under modified operations.

Hello,

I have a question and comments.

The question: for advanced controls approach: Is the low percent approach at year zero and 10 is affected with initial and O&M costs of advanced controls devices?

The comments: 1- I think the modified operations approach is not applicable:

Because: a- it can not be adjusted for whole turbine life.

b- the target is not to affect the annual product but to increase it.

c- with the continues researches to increase the production rate of each turbine,then the annual loss will be higher and with more affect with the advanced turbines.

2- I think the targeted inspection approach will be the most profitable.

3- I think advanced control will be profitable also specially with the continuous researches for a new designs of wind turbines to increase its capacity,then the initial and O&M costs of control devices will be with less effect.

Thanks for your time,

Thanks for your effort to do that paper

With best regards,