The Spanish government’s recent move to block closures of inefficient power plants presents the latest example of a trend toward expensive political interference in electricity markets.

Elsewhere in Europe, similar intervention can be seen in the shape of “capacity payments” that prop up gas, coal and nuclear power, as well as more recently in the U.S., where the government is proposing “grid reliability” payments to coal and nuclear plants.

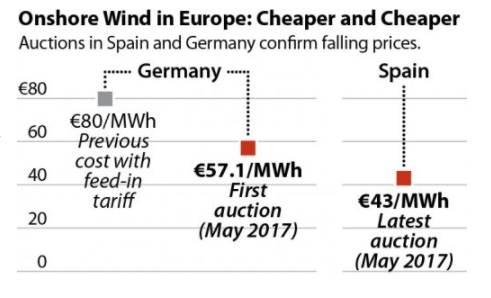

IEEFA suggests that if the Spanish government would let markets respond to power demands, more news would report figures like those above.

Such interference adds directly to electricity costs, through consumer or taxpayer supports, and indirectly, by creating system overcapacity. Random government interventions like the one proposed in Spain also create market uncertainty.

Endesa’s outdated coal-preservation investments run afoul of an emerging trend toward coal phase-out elsewhere in Europe.

The Spanish-government intrusion would allow the government a veto over closures of uneconomic plants, regardless of the wishes of the electric utilities that operate them. While the stated goal of the policy is to preserve the country’s security of supply, Spain has a capacity margin of about 30 percent, measured as the excess of supply above peak demand. That far exceeds the 10 to 15 percent margin that grid operators might actually need to ensure against the risk of large plant outages and to mediate the variability of wind power.

Spain’s overcapacity is a result of previous government interventions in the market and in particular the country’s capacity market, which pays to keep coal, gas and hydropower plants in the system regardless of whether they generate electricity.

We can point to three examples of costly political intervention in the Spanish electricity market.

First are the direct costs of nearly €1 billion paid out annually to subsidize Spain’s capacity market. IEEFA last year reported in detail on this aspect (“Spain’s Capacity Market: Energy Security or Subsidy?”).

Second, the capacity market combined with regulations that prevent the closure of idle capacity, has led to over-capacity, where cleaner-burning gas power plant, as a result, sit idle in favor of older, more expensive, and more polluting coal plants. Remarkably, for each of the past five consecutive years, Spain’s 25 gigawatts (GW) or so of combined cycle gas turbines (CCGT) have operated at below 20% capacity. Clearly, capacity payments to prop up widespread idle generation are a poor value, and one result are additional social costs in terms of sulfur-oxide, nitrogen-dioxide, and carbon-dioxide emissions.

Third, government interference undermines sound economic decisions by utilities. This point was written large last week when Spain rolled out its draft decree in what appeared to be a rebuke of Iberdrola’s announcement that it wants to close its last two coal-fired plants.

Iberdrola has stated that the closures of the plants in question will not undermine grid stability, given that it operates some 5.7 GW of CCGTs.

For the rest of the article: https://goo.gl/MbkSZK

Filed Under: Policy