This technical report come from NREL. The preface and executive summary are here.

Preface This work responds to a request made in October 2012 by Senator Jeff Bingaman, who has since retired. At the time, Senator Bingaman was the Chairman of the Senate Committee on Energy and Natural Resources. Senator Bingaman requested that the National Renewable Energy Laboratory (NREL) estimate the level of continuing policy support necessary to avoid significant disruption to domestic wind industry manufacturing and employment. Funding for the work was provided by the U.S. Department of Energy, Office of Energy Efficiency and Renewable Energy. The production tax credit (PTC) has been the primary federal incentive for deployment of wind power in the United States since it was first enacted as part of the Energy Policy Act of 1992. The credit establishes a production incentive for qualifying projects during the first 10 years of commercial operation and has been renewed eight times since its initial passage; renewals have often occurred near to or soon after expirations. Most recently, the PTC was extended by one year through December 31, 2013. Although the PTC has now expired, this extension included an adjustment of eligibility criteria that is expected to result in the qualification of projects that began construction in 2013 and maintain construction into 2014 and 2015; under current IRS guidance, projects that maintain construction into 2016 might also qualify.

Executive Summary The production tax credit (PTC) has been the primary federal incentive for deployment of wind power in the United States since it was first enacted as part of the Energy Policy Act of 1992. The PTC establishes a production incentive for qualifying projects during the first 10 years of commercial operation and has been renewed eight times since its initial passage; renewals have often occurred near to or soon after expirations. Most recently, the PTC was extended by one year through December 31, 2013. Although the PTC has now expired, this extension included an adjustment of eligibility criteria that is expected to result in the qualification of projects that began construction in 2013 and maintain construction into 2014 and 2015; under current IRS guidance, projects that maintain construction into 2016 might also qualify. The PTC has been critical to the development of the wind industry and deployment of wind generation capacity in the United States over the past two decades.

![Dark yellow and green lines represent the projected cost of natural gas-fired generation based on reference case fuel prices derived from the Energy Information Administration (EIA) Annual Energy Outlook (AEO) (EIA 2013b); for wind the dark blue line represents the generation cost associated with wind plants operating in median wind resource quality sites plus cost adders to reflect the provision of consistent capacity and energy resources to the system. More specifically, when comparing wind with new gas-fired generation (left), cost adders are included to reflect the incremental system capacity ($5/MWh as reported by EnerNex [2010], IEA [2010], Milligan and Porter [2008]) required to provide a capacity value comparable to a new combined cycle gas-fired plant and to cover incremental balancing expenditures ($2/MWh as summarized by Wiser and Bolinger [2013]) associated with the addition of variable generation into the power system. When comparing wind with existing gas-fired generation (right), as a fuel saver and assuming no need for additional capacity, only the balancing expenditures cost adder is included. 7 Wind cost reductions are based on the median, 25th, and 75th percentile literature cost reduction trajectory for wind power (Lantz et al. 2012). Bands represent uncertainty in projected costs as reported by Lantz et al. (2012) for wind and EIA (2013b) for natural gas. High and low gas prices are based on prices reported in the EIA’s AEO low and high resource recovery scenarios. The gaps between the median wind cost reduction trajectory (dark blue line) and the reference case gas-fired generation cost (dark yellow and green lines) are used to inform the development of ramp-down scenarios discussed in Section 2.](https://www.windpowerengineering.com/wp-content/uploads/2014/08/NREL-report-on-value-of-PTC-graphs-1.jpg)

Dark yellow and green lines represent the projected cost of natural gas-fired generation based on reference case fuel prices derived from the Energy Information Administration (EIA) Annual Energy Outlook (AEO) (EIA 2013b); for wind the dark blue line represents the generation cost associated with wind plants operating in median wind resource quality sites plus cost adders to reflect the provision of consistent capacity and energy resources to the system. More specifically, when comparing wind with new gas-fired generation (left), cost adders are included to reflect the incremental system capacity ($5/MWh as reported by EnerNex [2010], IEA [2010], Milligan and Porter [2008]) required to provide a capacity value comparable to a new combined cycle gas-fired plant and to cover incremental balancing expenditures ($2/MWh as summarized by Wiser and Bolinger [2013]) associated with the addition of variable generation into the power system. When comparing wind with existing gas-fired generation (right), as a fuel saver and assuming no need for additional capacity, only the balancing expenditures cost adder is included. 7 Wind cost reductions are based on the median, 25th, and 75th percentile literature cost reduction trajectory for wind power (Lantz et al. 2012). Bands represent uncertainty in projected costs as reported by Lantz et al. (2012) for wind and EIA (2013b) for natural gas. High and low gas prices are based on prices reported in the EIA’s AEO low and high resource recovery scenarios. The gaps between the median wind cost reduction trajectory (dark blue line) and the reference case gas-fired generation cost (dark yellow and green lines) are used to inform the development of ramp-down scenarios discussed in Section 2.

Due to growth in U.S. manufacturing capacity, the estimated import fraction for new plant installations has steadily declined from 75% of total turbine costs in 2006-2007 to less than 30% in 2012. Despite recent record-setting deployment and a trend of increasing domestic content in its supply chain, the U.S. wind industry faces several challenges. Current and near-term state renewable portfolio standard (RPS) targets have largely been met and are not expected to support more than 1–3 GW per year of new wind construction through 2020.

Abundant new sources of low-priced natural gas have altered the competitive landscape in the power sector, and the modest economic recovery, coupled with successful energy efficiency investments, has limited growth in demand for new electricity generation of all types. In response to these challenges, questions have been raised concerning the effect that PTC expiration could have on installations of new wind generation capacity and, more broadly, on domestic wind industry manufacturing, economic output, and employment. This analysis explores the potential effects of PTC expiration and various extension scenarios on future wind deployment with the Regional Energy Deployment System (ReEDS), a model of the U.S. electricity sector.

ReEDS is unique among national capacity expansion models for its detailed regional structure and statistical treatment of the impact that variable wind and solar resources have on capacity planning and dispatch. The analysis considers deployment results in the context of recent wind industry installation and manufacturing trends. The analysis does not estimate the potential implications on government tax revenue associated with the PTC. v This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications.

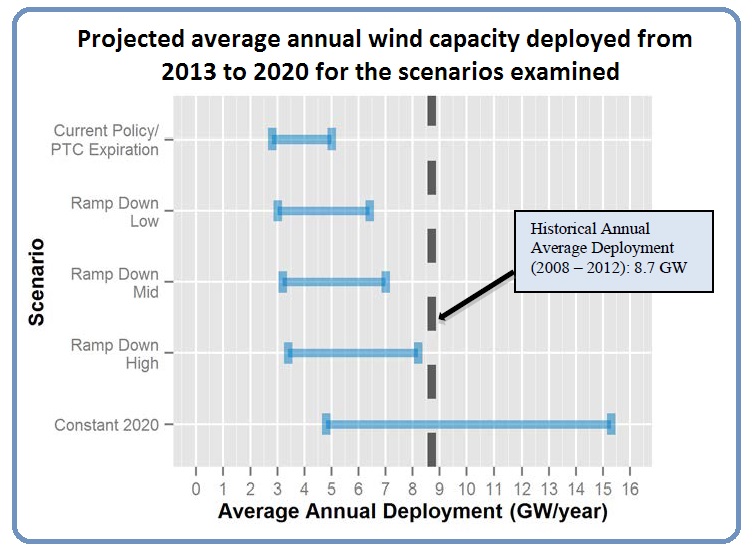

A PTC expiration scenario (Current Policy/PTC Expiration) and five conceptual designs for a PTC extension are explored. Two extension scenarios extend the PTC at its current level (taking into account adjustments for inflation over time) for different lengths into the future (Constant 2020, Constant 2030). Three scenarios ramp the credit down from its current level until it terminates in a future year. The three ramp-down designs are intended to explore scenarios in which a sufficient incentive is available such that median resource quality wind generation costs are on par with estimated electricity generation costs from new gas plants (Ramp Down Low), existing gas plants (Ramp Down High), and an intermediate case between these two (Ramp Down Mid). In the three ramp-down scenarios the PTC remains in place (with declining value) through 2020, 2022, and 2021, respectively. Analysis results are reported in ranges to reflect uncertainty in future natural gas prices and load growth. Projected fuel prices and load growth are derived from high and low values reported in the Energy Information Administration’s Annual Energy Outlook 2013.

Wind technology costs across all scenarios are grounded in observed 2012 data and assume a reduction in levelized cost of energy (LCOE) of approximately 15% by 2020 and 20% by 2025. Two types of power plant retirements are simulated in the analysis: those in the near-term that have already been announced by utilities, and those over the longer-term that occur as a function of plant age and dispatch characteristics. Figure ES-1 shows the projected average annual wind deployment from 2013–2020 for the policy scenarios analyzed. The results indicate that U.S. wind power deployment through 2020 is sensitive to both the prospective level of the PTC and market conditions over time.

Ranges shown reflect sensitivity to changes in natural gas prices and electricity demand growth. Sensitivities are coupled to provide a high and low value for the impact of a given scenario. All modeling results rely on a single set of cost and performance inputs for renewable and non-renewable power generation technologies as well as a single set of projected electric generation capacity retirements.

Historical Annual Average Deployment (2008 – 2012): 8.7 GW vi This report is available at no cost from the National Renewable Energy Laboratory (NREL) at www.nrel.gov/publications. More specifically, key findings of the analysis include:

• Under a scenario in which the PTC is not extended (Current Policy/PTC Expiration) and all other policies remain unchanged, wind capacity additions are projected to be between 3 GW and 5 GW per year from 2013–2020.

• U.S. wind power manufacturing production generally aligns with average annual wind power capacity additions from 2008 to 2012. In the absence of U.S. domestic demand for new wind capacity, global markets are unlikely to offer many opportunities for U.S.- based manufacturers. Given the limited export market, a reduction in domestic wind power deployment is likely to have a direct and negative effect on U.S.-based wind turbine manufacturing production and employment.

• Modeled PTC extension options that ramp down and cease support by year-end 2022 (Ramp Down Low, Ramp Down Mid, Ramp Down High) appear to be generally insufficient to support deployment close to recent levels and therefore may be insufficient to sustain the current industry domestic manufacturing and supply chain through 2020.

• Of the scenarios considered, an extension of the PTC at its historical level (Constant 2020) could provide the best opportunity to support deployment consistent with recent levels across a range of market conditions; it therefore could also provide the best opportunity to sustain the existing wind installation and manufacturing base at its current level.

• In the current low-priced natural gas regime, modeling results indicate that future wind deployment will be relatively low unless additional incentives are provided that result in wind being cost competitive with existing gas-fired generation.

• Future uncertainty in key modeling variables, including gas prices and load growth, translates into high levels of uncertainty in the deployment outcomes of specific extension scenarios.

The full report is here: http://www.nrel.gov/docs/fy14osti/61663.pdf

Filed Under: Financing, News