This article comes from S&P Global Ratings.

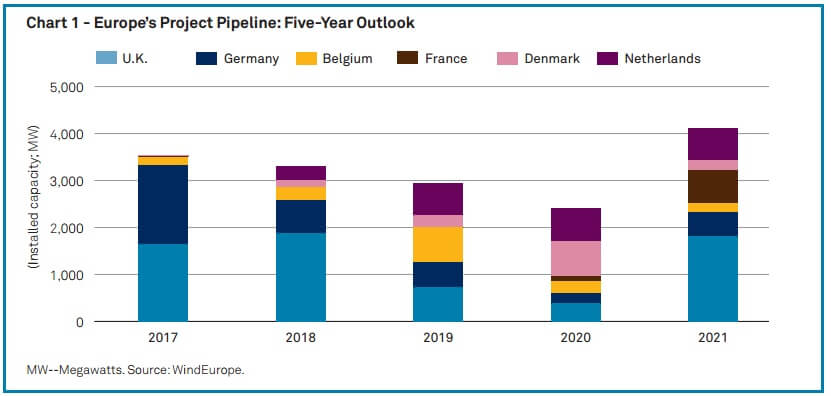

Rising investments in renewable energy as well as falling costs for its technology are spurring massive increases in offshore wind power capacity worldwide. Global cumulative offshore wind capacity increased by 2,219 MW or 18% in 2016, and the Global Wind Energy Council estimates that it could expand by another 3 GW in 2017.

S&P Global Ratings expects pricing in pending offshore wind projects to fall further in mature markets as generation costs continue dropping, mainly because of technical evolution and supply chain involvement.

Overview

Europe’s offshore wind industry is the most mature, while further development of the nascent industry in the U.S. will depend on wind regimes, site conditions, supporting infrastructure, and favorable regulation.

- Improving technology is making offshore wind power an increasingly viable energy source worldwide.

- Yet, technological, geographical, and regulatory limitations could still limit the credit quality of offshore wind projects.

- Europe’s offshore wind industry is the most mature, while further development of the nascent industry in the U.S. will depend on wind regimes, site conditions, supporting infrastructure, and favorable regulation.

- China’s offshore wind capacity looks set to increase fourfold by 2020, but in Latin America, the industry’s development will likely take longer.

Still, the industry faces many limitations that could have credit consequences if the risks are not overcome. These include technological risks, such as the need for larger vessels during the construction phase, a limited number of players able to conduct construction, limited market availability, a complex and long design process, and a lack of industry standardization. Exposure to fluctuating steel prices should also not be ignored. However, if the lower costs for offshore wind are sustainable, and if they can be transferred to the nascent U.S. industry, the future for the emergent offshore industry will be brighter.

Against this background, we believe three major factors will affect the creditworthiness of projects in this fast-developing sector: regulatory and political risks in new markets; the extent to which further technological developments can decrease costs; and grid connection limitations given the rapid increase in new projects due to go live over the next few years. (For further details see “With Offshore Wind Projects Set To Take Flight, What Factors Will Move Ratings?,” published Feb. 12, 2016, on RatingsDirect.)

Technologies are improving

The cost of energy from offshore wind has fallen considerably over the past five years. In the U.K., where offshore wind-power generation is well advanced, it has fallen by 32%. Projects reaching Final Investment Decision in 2015/2016 achieved an industry average levelized cost of energy, which measures lifetime costs divided by expected power output (LCOE), of $121 per MWh, compared with $181/ MWh (£95/MWh from £142/MWh) in 2010/2011, according to the Offshore Wind Programme Board. This means the $127 (£100) LCOE was achieved four years ahead of the government’s 2020 target.

Technological developments have contributed most to cutting costs, although final price reductions resulting from lower internal rate of return (IRR) requirements and financial optimization have also played a part. Now, however, governments are moving toward more market-oriented projects, either through auctions or tenders. Auctions require project owners to assume overall responsibility for developing projects, including site selection, project development, and construction of the wind farm and transmission grid. These are prevalent in countries such as the U.K., Germany, and the U.S.

Technological developments have contributed most to cutting costs, although final price reductions resulting from lower internal rate of return (IRR) requirements and financial optimization have also played a part. Now, however, governments are moving toward more market-oriented projects, either through auctions or tenders. Auctions require project owners to assume overall responsibility for developing projects, including site selection, project development, and construction of the wind farm and transmission grid. These are prevalent in countries such as the U.K., Germany, and the U.S.

German auctions differ in that they do not include the onshore substation, transmission cables and offshore converter station, which are provided by the transmission system operator. Projects in these countries require project owners to have high-level execution skills and entail considerable capital requirements and investments up until project approval. Tenders, by contrast, involve governments inviting tenders for predefined projects on sites selected by the national energy authorities, which have already carried out the necessary technical pre-investigations of the seabed and wind conditions. These are prevalent in Denmark and the Netherlands.

Compared with full-scope projects, they require significantly lower up-front investments, and project owners need not have such high technical competence, entailing lower risk for the project owners. We expect pricing in future offshore wind projects will fall further in mature markets as technology costs continue to decline and project sizes continue to increase. Up to now, bid prices have depended on:

- Technical evolution that has led to larger, more effective turbines and improved foundations

- The inclusion of supply chain in the industry, which has brought greater construction and operating and management (O&M) synergies due to economies of scale

- Site specifics, such as the wind resource available, seabed surface, water depth, and distance to shore

- The cost of developing and installing the grid to transmit the electricity

- Cost of capital, and

- Market conditions (subsidy scheme, duration, inflation, tax).

Given that wind turbine generators (WTGs) account for most capital and operating expenses, rotor sizes will continue to increase in the pursuit of economies of scale. In turn, this will reduce the number of foundations and the cost per MW, improving yield and O&M efficiencies. Increasing availability of offshore wind purpose-built vessels on the market, greater involvement of oil and gas majors, and a good range of specialized vessels for specific operations (such as WTGs, foundations, and cables) are set to lower costs further. Cable routes that avoid port areas could help limit costs because greater marine traffic leads to tighter operational constraints and cable burial depth requirements.

For the rest of the 14-page report: spglobal.com. For further discussion on the topic in the U.S., reach Michael Ferguson at michael.ferguson@spglobal.com

Filed Under: Offshore wind