This article comes from NREL’s David Feldman

Project Finance is a commonly used financing structure for large infrastructure projects which offers companies and investors many benefits over traditional corporate finance. While it has certain limitations and requirements, project finance can be used to raise a large amount of funds in an efficient manner. Renewable energy projects in the U.S. are often well suited to fit within these requirements and this structure has been used to raise over $100 billion to deploy tens of gigawatts of systems across the country.

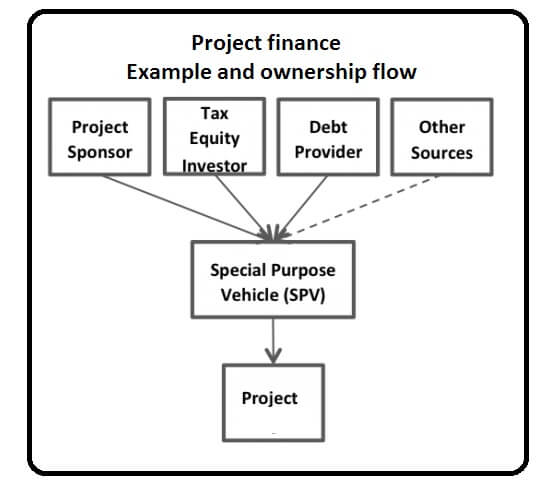

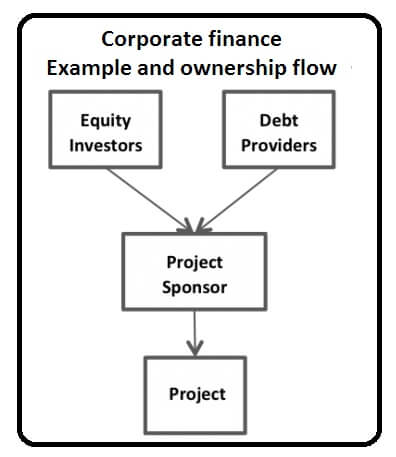

In traditional corporate finance a company can raise capital by offering an equity ownership stake in the company itself – and a claim to any distribution of cash the company may make. A company can also raise corporate debt, providing interest payments and a claim to the company’s assets should a default occur. To assess these investment opportunities equity and debt holders look to the health of that company and its ability to generate a return. Project finance, on the other hand, is a method in which a company, often referred to as a project sponsor, raises capital through a special purpose vehicle (SPV)—essentially a “shell” holding company— and equity and debt holders rely on the cash flows of the assets in this entity to recover their investment. The SPV is owned by the project sponsor and other investors, all of which in turn own the project.

Project finance offers many advantages over traditional corporate finance. First, project finance greatly minimizes risk to the project sponsor, as compared to traditional corporate finance, because any investor can only rely on the SPV and its assets for repayment in the case of default or dissolution. This is known as “non-recourse” financing. Secondly, SPV’s can potentially raise less expensive capital by separating the riskiness of a project sponsor from that of a project. If the risk of a project is less than that of the overall risk of the project sponsor, investors may be willing to accept a lower return. This is often true for renewable energy developers which act as project sponsors because project development is riskier than project operation.

Another reason a project sponsor may want to use non-recourse financing is because debt can be raised at the SPV level (i.e. not the corporate level) and therefore it can have a significantly smaller effect on that company’s balance sheet and therefore financial health.

SPVs also have the potential to offer more flexibility in how a financial arrangement is structured, particularly in financing renewable energy projects. In many cases renewable energy projects generate a significant amount of tax benefits, in the form of tax credits and deductions (i.e. capital expenses depreciated at an accelerated rate). Many project sponsors cannot efficiently utilize these benefits, but SPV’s allow project sponsors to partner with other investors (called “tax-equity” investors) to efficiently use these benefits (see: Feldman and Bolinger (2016) for further information on the various types of financing structures involving tax benefits).

Project finance expands the potential investor pool to other sources as well. Recently, project sponsors have developed new investment products for renewable energy projects that share many of the attributes of traditional project finance but at a larger scale. These products include “yieldcos” and asset backed securities (ABS) (for further information on these structures please see Feldman and Bolinger (2016)). Each of these financing options has its particular limitations, however bringing in other sources of capital allows sponsor equity providers to focus more of their capital on growing their core business rather than being tied up in projects.

Advantages to other equity & debt providers

When a project has a long-term offtake agreement with a highly creditworthy institution, investors in a project receive guaranteed, long-term benefits directly, without getting mixed into a large corporate balance sheet. This is particularly beneficial for senior secured lenders which have first rights to any cash generated from the project.

Additionally, in the case of tax-equity investors, many of the tax benefits accrue to the project independent of other risks, such as the financial strength of the offtaker or project sponsor, or the performance of the system (except in the case of the production tax credit). Tax equity also does not typically make an investment until the project is operational, and therefore does not have any construction risk as well. This means that as long as there is not a change in ownership during the period when the tax credits are vesting (5 years for the ITC), tax equity will earn a significant portion of their return without too much project-level risk exposure.

Not every project is suitable for project finance

While project finance arrangements can be economically beneficial they do take considerable effort to set up; this is particularly true for first-time project sponsors or technologies, and for non-standardized transactions. Additionally, due to the various investors and corporate entities, there are greater disclosure and reporting requirements than traditional corporate finance. Large projects are typically the only ones able to bear the fixed costs associated with setting up project finance legal structures and agreements between parties.

Additionally, because investors are reliant solely on the project for their return, they require a project to have a low level of risk. In order to manage risks renewable energy projects typically contract cash flows with energy offtake agreement, often referred to as a power purchase agreement (PPA). Under a PPA the SPV sells the output from the project to an offtaker, which is obligated to purchase the output of the project for a defined period of time at a specified price. Offtake agreements remove price risk and the risk of finding a buyer, depending instead on the reliability of a project and the credit strength of an offtaker; project finance is only used when both are strong.

Management of risk by equity & debt providers

In order to validate the low levels of project risk, equity and debt provider typically perform a large amount of due diligence so they can better understand the risks associated with a project. Standardized documents and operating procedures and independent project evaluation can minimize transaction times and create more transparency. Due to the various parties involved in a project finance transaction a key risk mitigation strategy is properly structuring each contractual agreement between participants.

One of the critical elements in contract structure is determining investor seniority to a project’s cash flows. The higher the seniority, the less risk one has in a project. Lenders almost always have the first claim on cash flows, followed by tax equity investors, and then project sponsors. Some tax equity investors will not enter a transaction and many require a return several hundred basis point higher if there is project debt, and thus they are put in second position (Martin 2015).

Another important aspect in structuring a contract is instituting change control processes, which require investor and/or lender approval to make any changes to a project over the course of construction and completion. Equity and debt providers can also require achieved project milestones before releasing any funds to a project. In fact, construction financing for renewable energy projects is often separate and distinct from term project finance, as some investors will only enter a transaction when a project is operational.

Equity and debt providers can also manage risk through project diversification. For example, distributed PV projects are often aggregated together in “warehouse facilities” and sold as a bundle to investors. In this way, investors do not rely on the creditworthiness of one offtaker, but on a diversified group.

Considerations

Project finance allows companies to minimize corporate risk, achieve lower rates of return by separating project risk from corporate, access a broader array of investors, utilize tax benefits more efficiently, and keep a significant amount of liabilities off of a corporate balance sheet. While there are certain restrictions which may limit the type of projects which can utilize project finance, it is highly suitable for many large-scale infrastructure projects, and has been pivotal for the record levels of renewables deployed over the last decade.

For further reading on this topic, please see the following resources:

- Comer, Bruce. 1996. “Project Finance Teaching Note: FNCE 208/731 Fall 1996 Professor Gordon M. Bodnar.” The Warton School.http://finance.wharton.upenn.edu/~bodnarg/ml/projfinance.pdf

- Feldman, David, and Mark Bolinger. 2016. On the Path to SunShot: Emerging Opportunities and Challenges in Financing Solar. Golden, CO: National Renewable Energy Laboratory. NREL/TP-6A20-65638. http://www.nrel.gov/docs/fy16osti/65638.pdf(forthcoming)

- Groobey, Chris, John Pierce, Michael Faber, and Greg Broome. 2010. “Project Finance Primer for Renewable Energy and Clean Tech Projects.” Wilson, Sonsini, Goodrich & Rosati. https://www.wsgr.com/PDFSearch/ctp_guide.pdf

- Martin, Keith. 2015. “Solar Tax Equity Market: State of Play.” Chadbourne & Parke Project Finance News (May 2015).

- Public-Private Partnership Infrastructure Resource Center. http://ppp.worldbank.org/public-private-partnership/financing/project-finance-concepts#off

Filed Under: Financing, News