This article comes from the first page of Utilities Observer, a 46 page report, published by Morningstar.com.

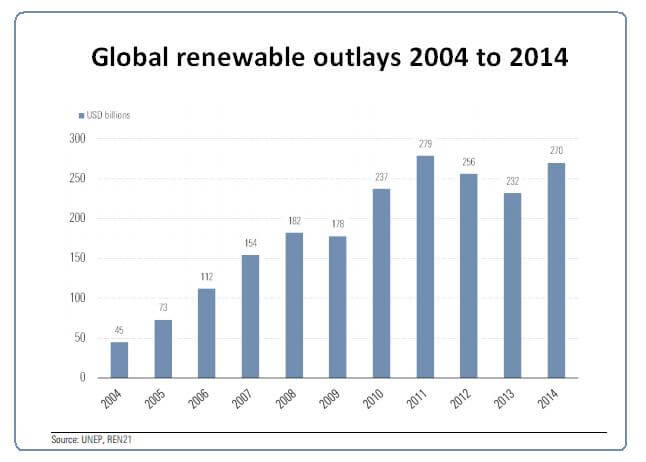

We expect high investment in renewable energy through 2020, but the path forward will be rockier than that of the past decade as policymakers turn to more discipline to protect the public purse. Renewable energy capacity has doubled during the past 10 years to roughly 1,800 GW in operation by year-end 2014, a 7% annualized growth rate. With a boom year in 2015—more than 130 GW of new capacity, according to IEA estimates—the global market seems frothy as ever. But while the sun still shines and the wind still blows, we see a rockier path ahead. More companies are chasing lower returns, and policymakers are second-guessing incentives that have propped up returns.

We expect high investment in renewable energy through 2020, but the path forward will be rockier than that of the past decade as policymakers turn to more discipline to protect the public purse. Renewable energy capacity has doubled during the past 10 years to roughly 1,800 GW in operation by year-end 2014, a 7% annualized growth rate. With a boom year in 2015—more than 130 GW of new capacity, according to IEA estimates—the global market seems frothy as ever. But while the sun still shines and the wind still blows, we see a rockier path ahead. More companies are chasing lower returns, and policymakers are second-guessing incentives that have propped up returns.

While this may paint a tough picture for investors, we see pockets of opportunity and support for economic moats. We think investors should focus on companies with renewable energy exposure through distribution and transmission investment; technology leadership in moaty asset classes; and extensive experience in renewable financing, development, and operations to support a competitive edge. We also think the renewable energy boom supports most regulated utilities’ growth outlooks, particularly in regions with strong regulatory support and low renewable energy penetration.

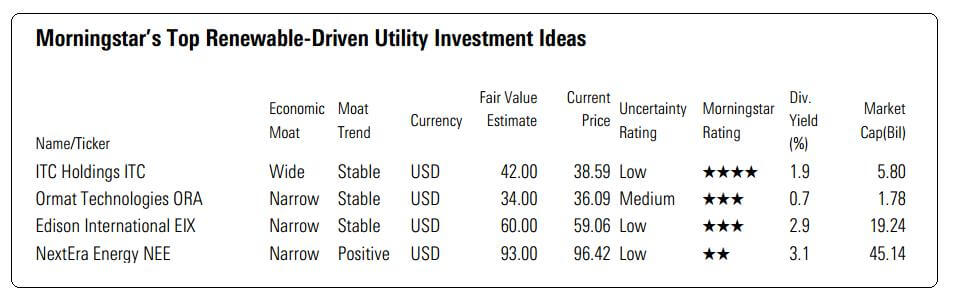

Renewable-energy-focused utilities are on balance fairly valued, but we highlight Best Idea ITC Holdings ITC, Ormat Technologies ORA, Edison International EIX, and NextEra Energy NEE as the primary winners from the long boom in global renewable energy investment.

Key takeaways – Why the renewable energy boom has legs

- The drive to green power is the well-understood and destructive impact of fossil fuel consumption: Investment in renewable energy is driven by the reality that the current consumption of fossil fuels, and related air pollution, water pollution, and public health costs, are unsustainable. As hundreds of millions of people push for higher living standards—and thus increased consumption of polluting resources— governments around the world are acting. With the recently adjourned COP21, stronger commitments are possible. We do not expect legally binding agreements on all parties to emerge from the talks.

- With policy support, high investment is set to continue: Though some governments have throttled back support following inefficient overbuild, the trend points upward in the largest markets, primarily the United States and China, and key new markets in emerging economies like India, Mexico, South Africa, Turkey, and others. With more players chasing development, and lower absolute subsidies in many cases, we think renewable energy investment returns may fall.

- Ormat is our favorite way to play renewable energy generation capacity: Even though we think the stock is currently modestly overvalued, Ormat Technologies—a narrow-moat pure-play geothermal developer—is the only independent power producer with an economic moat. It has a long and impressive growth runway well beyond our five-year explicit forecast, and its baseload geothermal generation has a major operational advantage over intermittent solar and wind.

- Renewable-energy growth was one factor in our recent midcycle power price cuts: We recently cut our midcycle outlook for Texas power markets by 20%, primarily because of the state’s huge pipeline of renewable energy projects that we expect to go into service during the next three to five years. There are more than 24.5 GW of active generation requests under review for new-build wind generation through 2020, including 11 GW in the next two years, with the state’s primary grid operator, ERCOT, or the Electric Reliability Council of Texas.

Filed Under: Financing, News, Policy