This article comes from a white paper from consultants at ICF and is authored by Pat Milligan

Power market factors will become increasingly important to the economics of wind going forward as opposed to raw capacity factor. This opens project opportunities in non–traditional areas where better market prices and more favorable wind shapes exist. Two such example areas are upper Michigan and coastal Texas, but others exist.

Executive summary

Executive summary

The phase–out of the Production Tax Credit (PTC) over the next few years will reshape the geography of wind development. As the PTC winds down and PPAs become less available, developers will increasingly have to consider market factors in siting of wind, and the criteria for finding the best sites for wind projects will change.

The high value of PTC credits has led wind developers to seek sites with the highest possible outputs, with less consideration of market pricing or wind shape. This has led to an abundance of wind in the middle of the country and in some cases depressed local electricity prices as wind capacity saturates markets. Going forward, locational market and resource considerations open up new geographies for further projects, if wind developers take note.

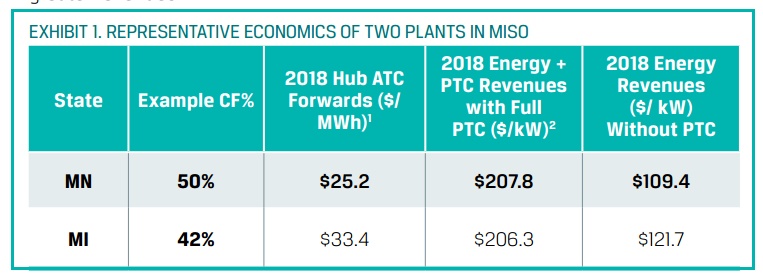

Currently, wind economics in many cases depend on high capacity factors to maximize monetization of the PTC. On a volumetric basis, at full ~$23/MWh the PTC may comprise fully half of a wind plant’s revenue stream. However, PTC credits will reduce to around $19/MWh for plants that begin construction in 2017 and to just $14/MWh in 2018. As the potential revenues from the PTC decrease, projects will need to make up a greater portion of their returns from realized energy prices.

In the market, this means a combination of both wind resource and hourly price shape. And while the PTC is indifferent to geography, price and shaping are much more location–specific.

Market pricing matters

Currently, most wind projects are located in a handful of states in the so–called “wind belt” from the Texas Panhandle up through southern Minnesota, where capacity factors are the highest. However, market pricing in many of these regions is depressed. As the PTC wanes and market based, off–take contracts grow in importance, these regions begin to look much less attractive.

For the rest of the five-page white paper, https://goo.gl/mAi8FB

Filed Under: Financing, News