Editor’s note: This research paper is provided by market advisory and consulting firm MEC Intelligence. It is authored by Rahul Kapoor and Sidharth Jain.

Since 2006-07, new wind markets have emerged in Eastern Europe due to high potential and favorable policy scenario. These markets, nearly 10 in number, collectively represent significant opportunity for PE (private enquity) investments.

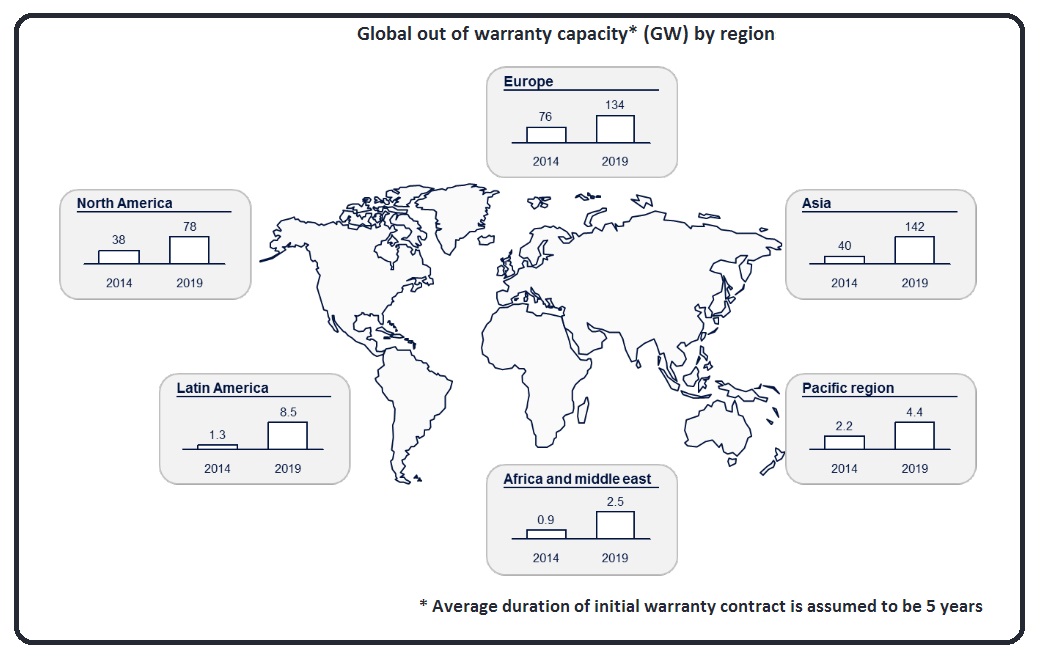

Wind industry has grown more than 20 times in past two decades with installations reaching ~370 GW in 2014 from only 17.4 GW in 2000. This tremendous growth in installations has in turn created a huge market for wind farm maintenance services. Traditionally, turbines are serviced under warranty contract by turbine OEMs for a few initial years. Assuming a standard five year warranty period, ~160 GW of the global wind capacity is expected to be out of warranty in 2014. Further, more than 40 GW capacity is expected to come out of warranty every year towards 2020.

Wind industry has grown more than 20 times in past two decades with installations reaching ~370 GW in 2014 from only 17.4 GW in 2000. This tremendous growth in installations has in turn created a huge market for wind farm maintenance services. Traditionally, turbines are serviced under warranty contract by turbine OEMs for a few initial years. Assuming a standard five year warranty period, ~160 GW of the global wind capacity is expected to be out of warranty in 2014. Further, more than 40 GW capacity is expected to come out of warranty every year towards 2020.

The turbine service market has traditionally been dominated by turbine OEMs, mainly due to their warranty period and technical knowledge. However, as the market is maturing and fleet is coming out of warranty, many localized independent service provider (ISPs) have emerged into the market, who offer a cost effective alternative to turbine OEMs. They are either specialized service providers or component OEMs. The success of ISPs, especially in mature and open markets like USA, Spain and Germany is visible from their revenue growth in recent years. For example, Deutsche Windtechnik, a Germany based ISP has seen a growth of ~32% in past five years with revenue reaching ~70 million Euro in 2014.

This growing market has already seen PE investments in several large ISPs of Denmark, Germany and USA since 2008. For example, Parcom Deutsche Private Equity, subsidiary of ING bank, acquired majority share in Availon in 2008. In 2010, Upwind raised ~27.2 million Euros from Kleiner Perkins Caufield & Byers and Mission Capital Group. Polaris Private Equity, in 2012, acquired majority stake in Connected Wind Services. The investments have proven to be effective as revenues of Availon and Connected Wind Services have nearly doubled since investments.

These markets, nearly 10 in number, have collectively added ~8.2 GW since 2006. Nearly 80% of this capacity is concentrated in Poland and Romania. The growth trend is expected to continue in coming years, for example, installed capacity in Poland alone is expected to reach 6.6 GW by 2020 (Poland’s National Renewable Energy Action Plan).

To tap this opportunity from services, new ISPs are expected to emerge, as was the case in mature markets like USA and Spain where the number of ISPs increased as the installed base grew. Also, ISPs from established markets like Germany and Spain are moving into nascent Polish and Romanian markets. For example, Deutsche Windtechnik entered Polish market around 2014 and has been successful in getting maintenance contracts from players like RWE (197MW in Poland). Availon, another leading ISP in Europe, is also present in these emerging markets.

Growth companies will be attractive for PE firms, but who are these growth companies?

No doubt that the growing service market will drive the growth of wind service providers, however, this ‘growth’ must be carefully assessed by PE firms in the screening process itself to identify the targets. Gazelle companies may not necessarily be the ones who will grow in future. In recent years, the landscape of wind services has been shifting from low value, labor based services towards high value, asset optimization services.

In addition to this, services like component remanufacturing, up-tower repairs and data based performance optimization are increasingly becoming of high value to the asset owners. Hence, in order to grow an ISP must have additional attributes in addition to growing revenue and strong customer base.

MEC Intelligence

www.mecintelligence.com

Rahul Kapoor is Senior Analyst with MEC Intelligence and has worked with leading clients across the wind energy value chain, advising them on supply strategies and growth opportunities. Contact him at rahul@mecintelligence.com.

Sidharth Jain is Director with MEC Intelligence and has worked on strategy, business development, investment, and innovation cases with both corporates and PE firms. He has extensive exposure in evaluating opportunities in wind market and supply chain globlly. Contact him at sidharth@mecintelligence.com.

Filed Under: News, O&M