Financial advisory firm Lazard has released an analytical report with an encouraging conclusion – the cost of wind power has come down by more than 50% in the past four years. The firm says that during an extended period of change and volatility, it has remained focused on the evolution of Alternative Energy and its convergence with the conventional Power & Utility Industry (as well as other industries). In that regard, Lazard says it has always believed that an essential question is how the current and projected costs of various Alternative Energy generation technologies compare to conventional generation technologies. Its most recent study of this topic is Lazard’s LCOE v7.0.

Reflecting Lazard’s approach to long-term thought leadership, commitment to the sectors in which we participate, and focus on intellectual differentiation, we have been publishing this study since 2008, and it is now in its seventh iteration. The study offers a variety of insights, including the following selected highlights:

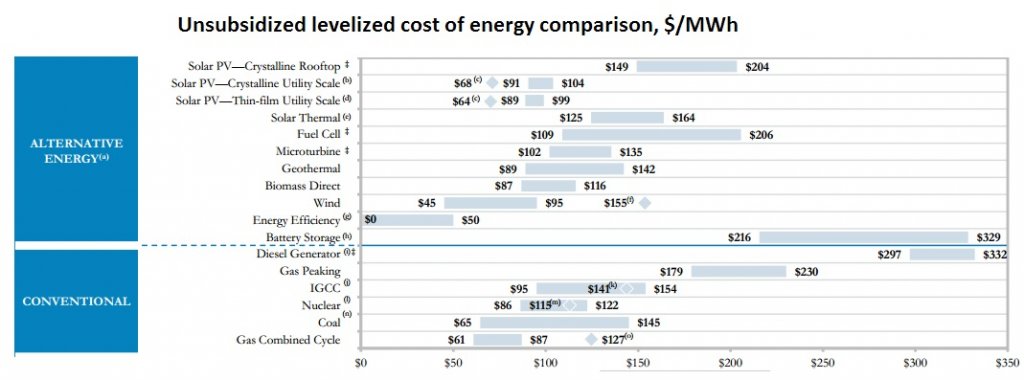

- The current and anticipated costs of all forms of utility-scale solar PV continue to decline;

- Lazard estimates that the LCOE of leading technologies has fallen by more than 50% in the last four years

- Utility-scale solar PV is a competitive source of peak energy as compared with conventional generation in many parts of the world, without any subsidies (appreciating the important qualitative differences related to dispatch characteristics and other factors)

Wind costs continue to decline. Lazard estimates that the LCOE of leading technologies has fallen by more than 50% in the last four years. While many had anticipated significant declines in the cost of utility-scale solar PV, few anticipated these sorts of cost declines for wind technology. Battery storage has an array of established and early-stage participants where estimated

LCOEs, combined, in particular, with wind and its off-peak production characteristics, may start to demonstrate value in load shifting, among myriad applications for storage

Residential-scale solar PV in the United States (and elsewhere) is benefiting from the concentration of multiple levels of federal tax subsidies, state-level tax subsidies, and/or feed-in tariffs. Currently, residential-scale solar PV remains expensive by comparison to utility-scale solar PV. Thus, an issue for consideration is whether these subsidies are distorting resource planning in a way that has externalities for the entire set of constituencies benefiting from an integrated electric utility system.

Very large-scale conventional generation projects (e.g., IGCC, nuclear) face a number of challenges, including: large cost contingencies; absolute costs on a heroic scale; LCOEs which suffer by comparison to natural gas in many parts of the world; and policy uncertainty. Notwithstanding these issues, an integrated electric utility system in an advanced economy requires modern baseload generation, there is value in diversity of generation resources, and effective public policy dictates the need for organized resource planning to maximize the benefits of an integrated electric utility system for all constituencies.

The study will continue to evolve by necessity (e.g., cost positions of solar and wind technologies are continually evolving, cost data for conventional generation technologies remain in a state of flux), and we appreciate that there are various views regarding the merits of some of the data inputs used.

The past several years have been marked by radical rationalization and retrenchment for many participants in the Alternative Energy sector. Even today, sector participants must navigate numerous challenges: creating rational, long-term financing structures for Alternative Energy deployment in the face of declining subsidies and various financing “fads” whose logic will ebb and flow over time; excess manufacturing capacity; and the globalization of end-markets, among other issues.

However, for all the well-publicized change and volatility in the sector, there also has been success in many important areas: the emergence of global-scale participants; deployment of some technologies at significant scale; thoughtful advancements in financing (particularly in respect of pension and infrastructure investors for existing assets); and great benefits to consumers as technology has improved and costs have fallen.

The firm says it has remained committed to the Alternative Energy sector during this time because it believes that new technologies will continue to be developed and deployed in complement with the existing technologies of integrated electric utility systems globally, where the new technologies are competitive on an LCOE basis. One example of this evolution can be seen in emerging “sustainable” solar markets such as the Mid-East, Chile and Australia, where solar PV technology can save energy consumers significant costs as compared with oil-fired electric generation (which remains in use in many parts of the world, particularly in remote locations).

As evidence of this ongoing commitment, Lazard says it has executed over 25 strategic assignments in the past 18 months for our clients in Alternative Energy. Furthermore, the company says it has raised over $225 million for FuelCell Energy in eight transactions over the past seven years. Various confidential advisory assignments for utilities, market participants and investors in respect of Alternative Energy, including technology assessments, analyses of potential strategic partners globally, public market trading dynamics, perspectives on key end-market trends, commercialization strategies, and potential and evolving sources of capital

Importantly, even as we believe that there will be long-term successes in many Alternative Energy sectors, there has been transactional activity which Lazard has declined to pursue, often because we believed that there were fundamental issues regarding the long-term viability of a given company in light of the competitive implications of the LCOE of its products. This insight, for example, was at the heart of our advice to a sovereign government to cease funding a troubled solar PV company. There have been similar examples in the areas of electric vehicles, solar PV and thermal technology, fuel cells, biofuels, and wind generation technology, among others.

This is an exciting update. It shows the tremendous progress that the wind industry has made in the last several years. It also makes the case that a long-term extension of the federal tax incentives that have driven these cost reductions – the renewable energy production tax credit (PTC) and investment tax credit (ITC) – will give wind energy companies the certainty they need to make further advancements, and achieve full cost-competitiveness with other energy technologies.

The federal tax incentives are set to expire at the end of this year, and there is only a slim chance that they will be extended prior to this date. One of the most feasible options for extending the credits is through the comprehensive tax reform legislation that the congressional tax committees are currently working on.

On this front, the company reports that 60 members of the U.S. House of Representatives recently sent a letter to their tax committee leaders, urging them to “include policies that promote America’s renewable energy economy” in that bill. You can weigh in with the tax committee leaders as well – visit this web page to see the template message that Lazard has prepared. You can personalize that message and send it in to the web site the tax committees have designed to accept feedback from the public – taxreform.gov. For the full report here.

Lazard

www.lazard.com

Filed Under: Financing, News, Projects

Why should/would we want to supplement with tax-payer money ( future generations money) ANY unproved technology? And why are we giving tax credits to companies from Federal Government for issues that Federal Government has NO

CONSTITUTIONAL business in the first place? The issue of wind generated power should be developed and sold and or subsidized in a free-market by those in business (NOT government) who will benefit from it by then selling it to the user. WITHOUT supplementation by tax-payers.

Why is LIZARD funding an employee’s campaign and “buying” his allegiance to their cause instead of caring for the people of the state of MINNESOTA? Mr. Mc Fadden is errant in his support and should – in all good conscience – return the money from Lizard to Lizard and distance himself from any and all of Lizard’s business if he is going to serve a constituency that strongly opposes their activity!

One cannot serve two masters!