Broadwind Energy announced $8 million in new wind-tower orders from a U.S. turbine manufacturer. The towers will be produced in Broadwind’s Manitowoc, Wisconsin facility for 2016 delivery. The company strongly credits the renewal of the Production Tax Credits (PTC) for the new contract. “The production tax credit that was passed just a few weeks ago…

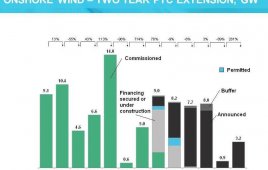

MAKE Consulting report says long-term PTC program charts new territory for the U.S. market

A Flash Note from Make Consulting examines the upside from the long-term extension of the federal PTC on the US wind power market outlook from 2016 to 2021.

Production Tax Credit – 5 things To know about the extension of the ITC/PTC

Among the 887-page budget bill’s myriad provisions is an extension of federal income tax credits for solar, wind and certain other renewable energy facilities.

It’s official: Congress passes tax extenders for renewable energy projects and bonus depreciation

Extensions to the production and investment tax credits that are applicable to wind, solar and other renewable power projects have been enacted pursuant to an omnibus spending bill passed by Congress.

Long-term extension of wind PTC will bolster growth of renewables

Siemens has welcomed the Congressional action to approve a five-year extension of the federal Production Tax Credit (PTC) for wind energy. The company has over 5,000 wind turbines installed in the U.S., capable of producing clean, renewable power for more than 2.5 million households every day. “On behalf of the nearly 2,000 Siemens wind energy employees…

AWEA: U.S. wind industry leaders praise multi-year extension of tax credits

By voting to pass the 2016 budget, which includes a multi-year extension of the wind energy Production Tax Credit (PTC) and Investment Tax Credit (ITC), Congress secured stability for 73,000 American wind industry workers across all 50 states and private investors helping to grow American wind power. “We’re going to keep this American wind-power success…

Wind energy gains predictability from tax credits’ multi-year extension

The agreement by congressional leaders last night on a multi-year extension of renewable energy tax credits would secure several years of predictable policies that encourage private investment in wind energy, industry leaders said today. “This agreement will enable wind energy to create more affordable, reliable, and clean energy for America by providing multi-year predictability as…

A few thoughts on a potential PTC extension

With a five-year phaseout of the PTC expected to be part of the package that Congressional negotiators are trying to work out, these thoughts provide some insight on the potential PTC extension:

Changing wind on Ways and Means Committee – PTC future is uncertain

This blog was authored by Elizatech Noll for Natural Resources Defense Council with assistance from her colleague Emily Barkdoll. With Congressman Paul D. Ryan becoming Speaker of the House, his seat as Chairman of the House Ways and Means Committee is up for grabs. Both Representative Pat Tiberi and Representative Kevin Brady have thrown their…

Bloomberg Energy has two forecasts for the wind industry, and more

The wind industry has a lot to be encouraged about if the forecasts from Bloomberg Energy’s Dan Shurey are correct. His research also found that the industry recognizes its rising O&M costs and shared a range of ideas for keeping the costs manageable. Shurey presented these ideas, findings, and more at the recent Wind Operator…

Clean energy industries join over 580 signers to urge congress to pass clean energy extenders

The Business Council for Sustainable Energy (BCSE) joined over 580 companies and organizations urging the passage of legislation that provides the extension of expired and expiring tax incentives benefiting clean energy technologies as soon as possible this year. “Businesses and investors need stable, predictable federal tax policy to create jobs, invest capital, and deploy pollution-reducing…

Bipartisan set of governors urge Senators to restore funding for wind energy research

From AWEA: Democratic Gov. Jay Inslee of Washington and Republican Gov. Terry Branstad of Iowa have sent a letter on behalf of the Governors’ Wind Energy Coalition calling on the U.S. Senate Appropriations Committee to reverse its decision to hamper long-term investment in research advancing American wind power. The governors’ letter was sent to Senate Appropriations…

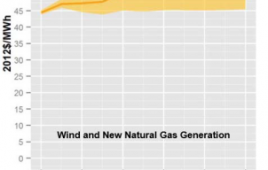

AWEA white paper: PTC has driven progress but the success story is not yet complete

With a two-third reduction in the cost of wind energy over the last six years, the renewable Production Tax Credit (PTC) is on track to achieving its goal of a vibrant, self-sustaining wind industry. That is the remarkable conclusion of analyses by national laboratories, consultants, and other independent experts and summarized in a new white…

Estimating the effects of the PTC based on turbines not built, jobs not created and taxes not paid

Wally Lafferty and Paul Dvorak Editor’s note: Mr. Lafferty and I published an earlier version of this editorial in the April issue of Windpower Engineering & Development. We now have the benefit of a more thorough financial review which is reflected in the dollar values here. Critics of the Production Tax Credit cite a report…

Good news, Virginia residents: You don’t pay a penny more for benefits of wind power

Those rascally wind critics are at it again. This from RealClearEnergy.org: Thomas Pyle, president of the American Energy Alliance, is not at all happy about wind’s success. He (mistakenly) says it comes through a series of tax subsidies that are giving wind a huge advantage at the expense of taxpayers. Here’s how he makes his case…

IRS updates “Beginning of Construction” guidance

The IRS has issued Notice 2015-25, updating its prior guidance in Notices 2013-29, 2013-60, and 2014-46. This is in regards to the “beginning of construction” requirement for the production tax credit (PTC) under Section 45 of the Internal Revenue Code (the Code) and the investment tax credit (ITC) under Section 48 of the Code. The…

Independent mind asks: Why such opposition to the PTC?

Editor’s note: This article, by David Jenkins, president of Conservatives for Responsible Stewardship, was originally posted on The Hill, Congress Blog, and is reposted here with permission. The article is entirely from the insight and effort of the author and was not solicited anyone in the wind industry. Former Sen. Don Nickels’ (R-Okla.) piece in…

President Obama’s State of the Union: U.S. leads world in wind energy production

This article comes from AWEA. In his State of the Union speech last night, President Obama highlighted U.S. wind energy leadership as an American success story. “As the President noted, America produces more wind energy than any other country in the world. We’re number one,” said American Wind Energy Association (AWEA) CEO Tom Kiernan. “Hard…

Making a case for the Production Tax Credit

Here’s a more balanced look at the benefits of the Production Tax Credit The Institute for Energy Research, one of the wind industry’s unconverted allies, released a grey paper of invented arguments against renewing the Production Tax Credit (PTC). The last I recall, the House passed the so-called extenders tax package that includes some 55…

Wind tax credits: A no-cost way to avoid greenhouse gas emissions

This commentary, from the American Wind Energy Association, is authored by Elizabeth Salerno, its Chief Economist and Director of Industry Data and Analysis, A new National Research Council (NRC) report out today acknowledges that renewable energy reduces greenhouse gas emissions. However, at least one fossil-fuel-funded group is already misreporting the findings by focusing on the…